Consumer Financial

Protection Bureau

You have a reverse

mortgage:

Know your rights and

responsibilities

About this guide

Your reverse mortgage basics .......................................................................................................... 3

Your reverse mortgage responsibilities .......................................................................................... 3

Requirement 1: Your home must be your principal residence.................... 3

Requirement 2: You must pay your property charges on-time................... 6

Requirement 3: You must keep your home in good condition ................... 9

If you cannot meet your loan requirements ................................................................................. 11

Default or foreclosure notices ....................................................................... 11

Natural disasters.............................................................................................. 11

Paying back your loan ...................................................................................................................... 11

Selling your house............................................................................................................................. 12

What happens to your loan after you die ..................................................................................... 13

If you have a co-borrower on your loan ........................................................ 13

If a “Non-Borrowing Spouse” lives in your home ........................................ 13

If you have heirs ............................................................................................... 16

How to get help................................................................................................................................. 17

Glossary.............................................................................................................................................. 19

1

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

Introduction

This guide is for reverse mortgage borrowers.

It provides information on:

§ Your reverse mortgage loan requirements

§ How to pay off your reverse mortgage loan

§ How moving out of your home or dying affects your reverse mortgage loan

§ What it means to default on your loan and where to nd help

§ What your heirs may need to know

Most reverse mortgages today are Home Equity Conversion

Mortgages (HECMs), which are federally insured by the U.S.

Department of Housing and Urban Development’s (HUD) Federal

Housing Administration (FHA). This guide covers typical features and

requirements for HECM reverse mortgage loans. Non-HECM reverse

mortgage loans may have different requirements and features.

Alert

At the back of this guide is a glossary with key reverse mortgage terms and

a list of organizations that provide help to reverse mortgage borrowers.

In the guide, the term “you” refers to you, the borrower, and any

other co-borrowers on the reverse mortgage loan.

2

Your reverse mortgage basics

Unlike a traditional mortgage, a reverse mortgage loan is repaid when the

borrowers no longer live in the home. Because interest and fees are added to

the loan balance each month, the amount you owe goes up—not down—over

time. As your loan balance increases, your home equity decreases.

Your reverse mortgage responsibilities

Although you do not make monthly mortgage payments with a reverse

mortgage, there are three main requirements you must meet:

1. Your home must be your principal (meaning primary) residence

2. You must pay your property charges, like property taxes and homeowners

insurance on-time

3. You must keep your home in good condition

Warning

Failure to meet these requirements may lead to default or foreclosure..

Requirement 1: Your home must be your principal

residence

Your home must be your principal residence, meaning it must be where you

spend the majority of the year. You can only have one principal residence at

a time. As Table 1 shows, with a reverse mortgage you can only be away from

your home for a certain period of time.

3

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

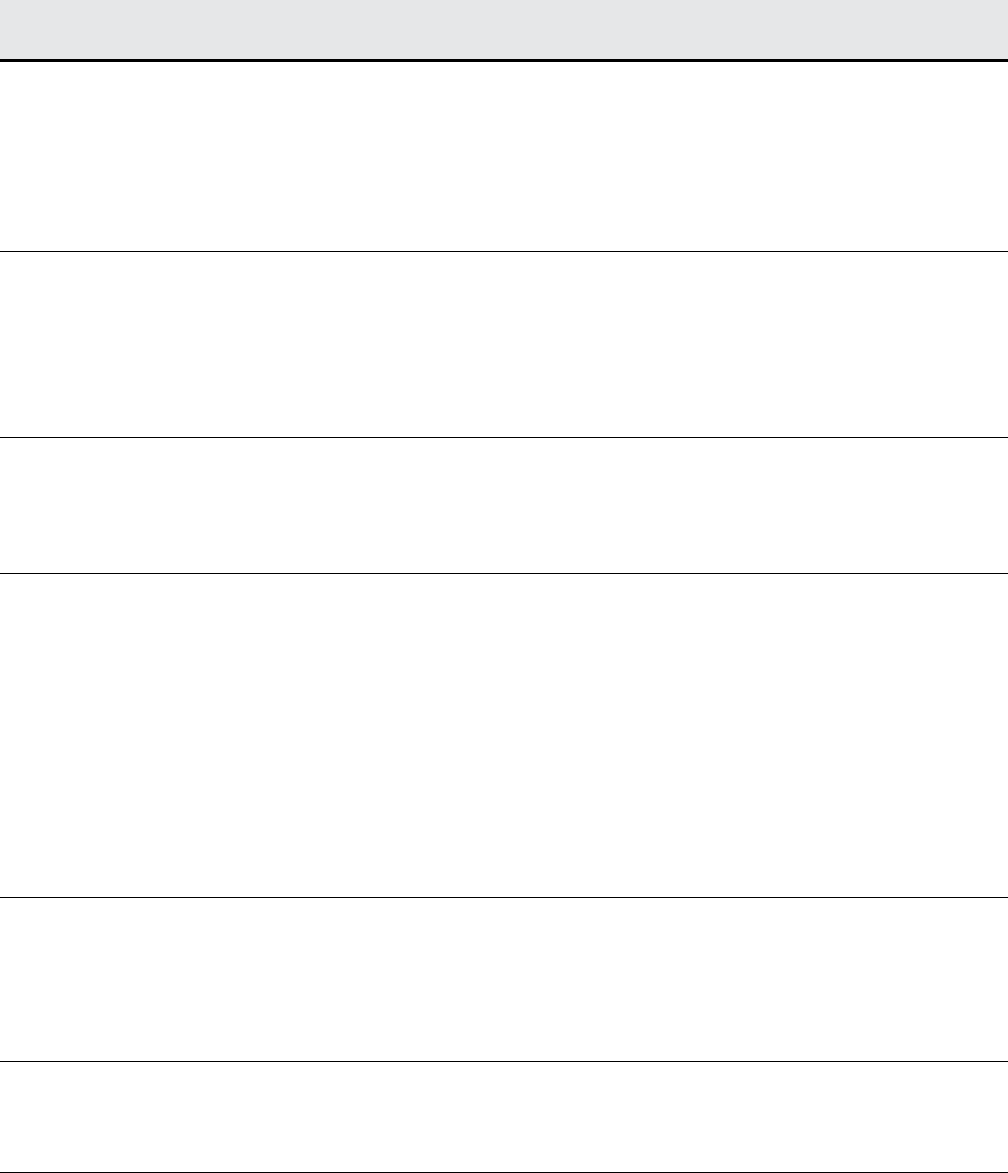

TABLE 1: HOW LONG YOU CAN BE AWAY FROM YOUR HOME WITH A REVERSE MORTGAGE

Length of time away Effects on your reverse mortgage

You are away for more

Notify your lender or servicer so that your lender knows you

than two months and

continue to occupy the home as your principal residence.

there is no co-borrower

living in the home

You are away for more

than 6 months for non-

medical reasons and

there is no co-borrower

living in the home

§ Your home is no longer your principal residence and your

loan must be paid back or satised through selling the

property or deed-in-lieu of foreclosure.

§ Anyone living with you will have to move out unless they are

able to pay back the loan.

You are away for more

than 12 consecutive

months in a healthcare

facility such as hospital,

rehabilitation center,

nursing home, or

assisted living facility

and there is no co-

borrower living in the

home

§ Your home is no longer your principal residence and your

loan must be paid back or satised through selling the

property or deed-in-lieu of foreclosure.

§ Anyone living with you will have to move out unless they are

able to pay back the loan.

There is a co-borrower

The co-borrower may continue to live in the home and receive

in the home and you

loan payments, so long as they continue to fulll the reverse

permanently move for

mortgage loan requirements.

any reason

4

I was asked to certify that I occupy my home. What is this? What if I

forgot to respond?

Your lender or servicer will require you to certify each year that your home is your

principal residence. Usually this is done through a postcard or other notice sent by

mail at the same time each year. If your spouse is designated as an “Eligible Non-

Borrowing Spouse” in the loan documents, you will also need to certify that you

are still married and that your spouse lives in the home as their principal residence.

To be an “Eligible Non-Borrowing Spouse” means that your spouse is not a co-

borrower, but qualies under HUD’s rules to stay in the home after the borrower

dies.

It is important that your annual occupancy certication is signed and returned

immediately. Failure to do so may lead to default or foreclosure.

5

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

Requirement 2: You must pay your property charges on-

time

Property charges are fees the borrower must pay under the reverse mortgage

loan, which can include:

§ Property taxes and homeowners insurance

§ Flood insurance premiums

§ Ground rents, condominium fees, planned unit development fees, or

homeowners’ association fees

§ Any other special assessments

Paying your property charges

§ For loans made before April 27, 2015: the borrower could have requested

at the time the loan documents were signed, for the lender or servicer to pay

the property taxes and homeowners insurance from the reverse mortgage

loan funds, but was not required to do so. Generally, borrowers need to

budget each year to make sure the taxes and insurance are paid on-time.

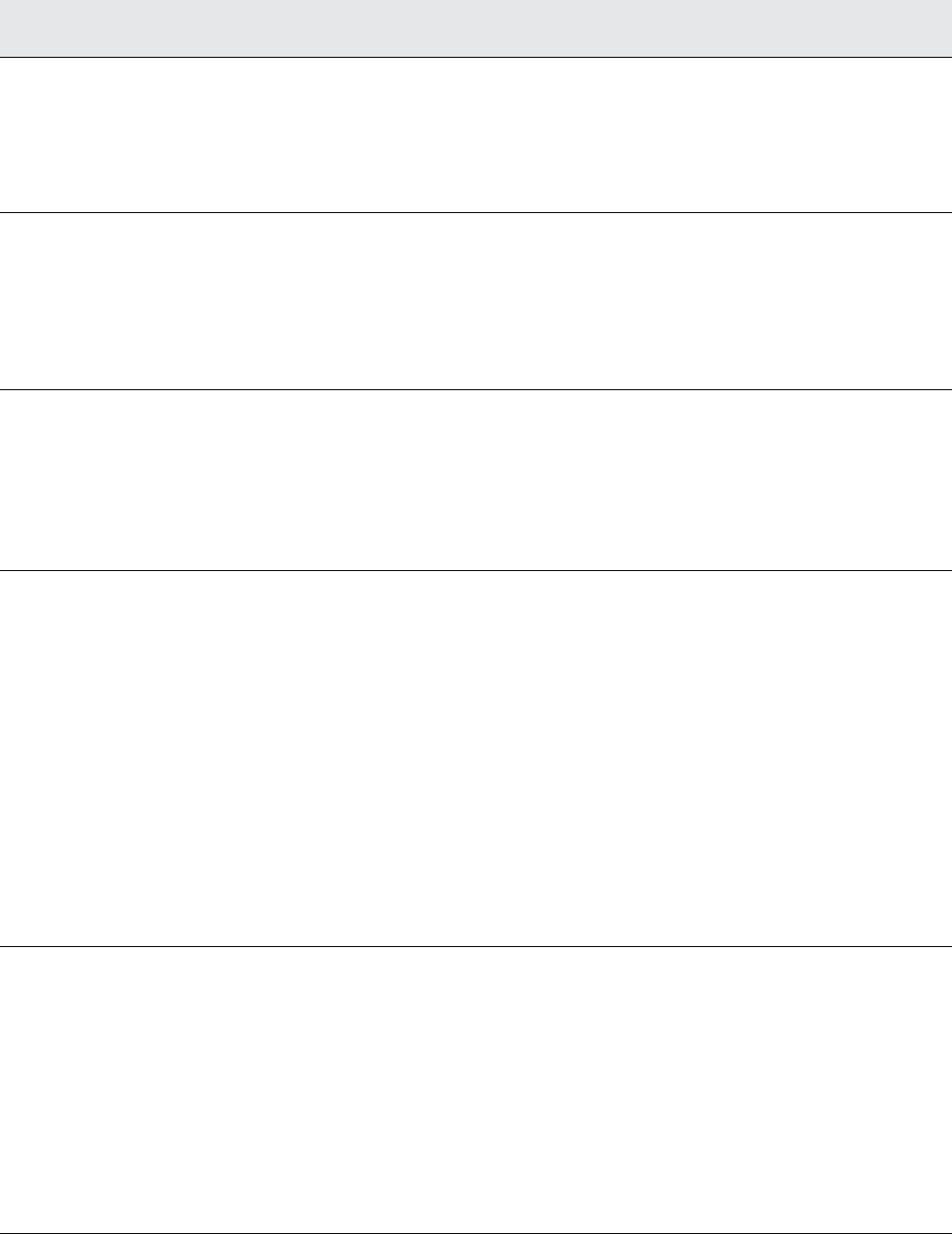

§ For loans made after April 27, 2015: lenders evaluate your ability to pay

future property taxes and homeowners insurance when making the loan. As

shown in Table 2, your lender may require you to set aside loan proceeds to

pay future property taxes and homeowners insurance.

Warning

The money set aside to pay for your property taxes and homeowners

insurance will not cover other charges like condominium fees,

homeowners’ association fees, and ground rents. You are solely

responsible for paying these other property charges.

6

TABLE 2: PAYING PROPERTY CHARGES FOR LOANS AFTER APRIL 27, 2015

Lender's evaluation Who pays the property taxes & homeowners insurance

If your lender determined

You can choose to:

that you had enough

§ Pay your property charges directly, or

money to pay future

property taxes and

§ Have your servicer pay your charges by using money

homeowners insurance

from your reverse mortgage funds.

If your lender determined

Your lender will choose to:

that you need to “set

aside” a portion of your

§ Pay your property taxes and homeowners insurance

loan proceeds

directly from the reserve, or

as a reserve

to pay your property

§ Send you the money so that you can make these

taxes and homeowners

payments.

insurance

§ If you are unsure if loan money was set aside, check your monthly

account statement or contact your lender or servicer.

§ If the reserve can no longer cover your property taxes or homeowners

insurance, your lender will tell you.

Warning

Unpaid property charges could put your reverse mortgage loan in

default. If you miss a payment or know that you will miss a payment,

contact your lender or servicer immediately. They may pay your

property charges by using money from your monthly loan pay out or,

if you have one, your line of credit. If there is not enough money to

cover the missed charges, your lender or servicer may advance the

funds and you will be required to pay them back.

7

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

Managing your property taxes

Here are some ways you can manage your property taxes.

§ You may be eligible to lower your tax payments if your state offers a tax

relief program for older homeowners. If your state has a senior property

tax exemption, you may need to apply to receive the benet. Many

state programs require you to apply shortly after the tax bill is issued.

To learn more, contact your local tax collector.

§ It is important to tell your lender or servicer if you are paying your

property taxes in installments. You do not want them to mistakenly

believe that you missed a payment.

§ If your lender wrongly determines that your loan is in default for unpaid

property taxes, contact your lender or servicer immediately. Be ready

to show proof that you have paid your property taxes.

Failure to pay property taxes

If your loan falls into default due to unpaid property charges, immediately

talk to your lender or servicer. You can ask for help from a HUD-certied

housing counseling agency or an attorney.

After you default you may be able to rehabilitate the loan through a

repayment plan or an “at-risk extension.” To qualify for an at-risk

extension, you must be at least 80 years old and experiencing critical

circumstances, such as: a long-term disability, terminal illness, or a unique

need to stay in the property. You may request to renew the at-risk

extension every year with proof of your need.

8

Requirement 3: You must keep your home in good

condition

When you applied for your reverse mortgage loan, your lender evaluated

whether your home met HUD‘s property requirements.

Now that you have the reverse mortgage loan, you must keep your home in

good condition. Your lender or servicer may inspect your home’s condition if

they give you notice and specify the purpose of the inspection. They also may

tell you to make repairs.

How long do I have to make required repairs?

You generally have 60 days to start repairs from the day your lender or servicer

noties you. Failure to do so could lead to default or foreclosure.

What if I cannot afford to make required repairs?

Reach out to your local Area Agency on Aging (AAA) to nd assistance

programs that may be able to help you pay for repairs. To nd the nearest AAA,

call (800) 677-1116 or visit eldercare.acl.gov.

9

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

Warning

If you need to hire a contractor to perform repairs on your house, you

may want to:

§ Explore and compare your options. Get estimates from several

contractors on the costs of repairs.

§ Ask people you trust for referrals.

§ Check if a contractor is licensed through your state’s contractors’

licensing board.

§ Have a lawyer review the contract of work.

§ Read and understand the contract before you sign it. Make sure

written contracts match any verbal promises made.

§ Beware of contractors going door-to-door. Do not feel pressured

into making a decision right away.

10

If you cannot meet the loan

requirements

Default or foreclosure notices

If you receive a default or foreclosure notice, immediately contact your servicer

to learn why. Unless steps are taken to x the default, you may lose your

home to foreclosure. Seek help from an attorney or a HUD-approved default

housing counseling agency. Both can explain what options you have to prevent

foreclosure.

Natural disasters

After a natural disaster, you may experience damage to your home, unexpected

expenses, or a sudden loss of income. All these things may make it difcult for

you to meet your reverse mortgage loan obligations. To nd help, read the

Reverse mortgage borrowers guide to natural disasters at, cfpb.gov/prepare.

Paying back your loan

Unless there is a co-borrower living in the home, you must typically repay the

loan when you no longer live in the home. You may need to pay it back sooner

if you fail to meet the obligations of the loan.

11

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

Selling your house

If you decide to sell your home while you have a reverse mortgage loan, you

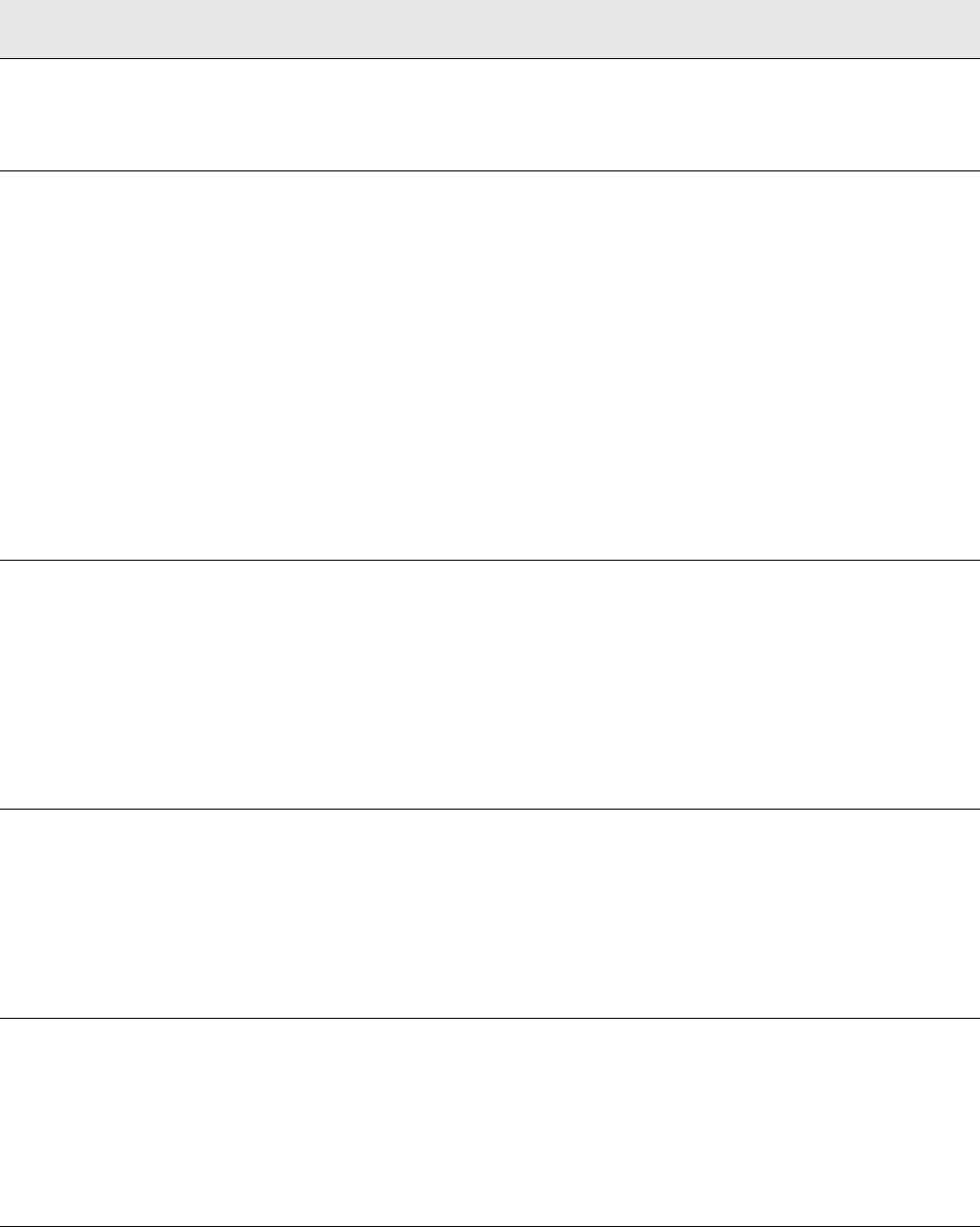

will have to pay back the money borrowed, plus interest and fees. As shown in

Table 3, the amount you receive from the sale of your home will determine how

the loan is paid back.

TABLE 3: HOW YOUR REVERSE MORTGAGE IS PAID IF YOU SELL YOUR HOME

Your home Money from the sale

You sell your home

§ The loan is fully paid back.

for at least the loan

§ You get to keep whatever money is left after paying back the loan.

balance

You sell your home

§ The money from the sale pays off the outstanding loan balance.

for at least the

§ Your mortgage insurance will pay any remaining balance if the

appraised market

sale does not cover the amount owed.

value

Your reverse

§ You may sell your home for 95 percent of its appraised value or

mortgage loan

the amount owed on the loan, whichever is less.

is in default and

§ The money from the sale will go towards paying the outstanding

you have received

loan balance.

a notice that the

loan is “due and

§ Your mortgage insurance will pay any remaining balance if the

payable”

sale does not cover the loan balance.

12

What happens to your loan after

you die

Unless there is a co-borrower living in the home, when, you die the loan

has to be paid back. As described below, when it must be paid back is

complicated.

If you have a co-borrower on your loan

After a borrower dies, any co-borrower on the loan may continue to

receive the benets of the reverse mortgage loan and may stay in the

home as long as they continue to fulll the loan obligations.

Tip

It is a good idea to check with your lender or servicer to make sure

your loan records are correct. Conrm your co-borrower is listed on

the loan.

If a “Non-Borrowing Spouse” lives in your home

Your Non-Borrowing Spouse may stay in the home if they pay off the

loan. They may also be able to stay in the home without paying off the

loan depending on when the loan was taken out and whether they qualify

under HUD’s rules. The process may be difcult. Your Non-Borrowing

Spouse may want to get help from an attorney or a HUD-certied housing

counseling agency.

13

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

If your loan case number was assigned on or after August 4, 2014

Your lender or servicer will determine if your Non-Borrowing Spouse

qualies to stay in the home after you die (called a "deferral period"). To

qualify your Non-Borrowing Spouse must:

§ Establish their ownership interest to the property or a legal right to

remain in the home for life. This must be provided to the lender or

servicer within 90 days of the borrower’s death.

§ Have been married to the borrower at the time the loan documents were

signed up until the borrower’s death. For couples who were unable to be

legally married based on gender at the time the reverse mortgage loan

was made, they must show that they were legally married by the time of

the borrower’s death.

§ Have been identied in the loan documents as a Non-Borrowing Spouse.

§ Have lived, and continue to live, in the home as their principal residence.

§ Continue to meet the loan requirements and make sure the loan does not

become due and payable for any other reason.

If your loan case number was assigned before August 4, 2014

After the borrower dies, the lender or servicer has two options. They can:

§ Foreclose on the home, or

§ Enter a process called “Mortgage Optional Election (MOE) Assignment”

that allows the Non-Borrowing Spouse to stay in the home.

14

Foreclosure

If your lender or servicer decides to foreclose on the home or nds that the

Non-Borrowing Spouse does not qualify for MOE Assignment, they must

begin foreclosure proceedings within six months of the borrower’s death. If

the Non-Borrowing spouse is actively trying to sell the property or satisfy the

debt in some other way, they may request a delay with the foreclosure for

up to 180 days.

Tip

If the Non-Borrowing Spouse receives a foreclosure notice, they should

take immediate action and not ignore it.

MOE Assignment

If the lender or servicer decides not to foreclose and to enter the MOE

Assignment process, to qualify your Non-Borrowing Spouse must:

§ Have been married to the borrower at the time the loan documents were

signed up until the borrower’s death. For couples who were unable to be

legally married based on gender at the time the reverse mortgage loan

was taken out, they must show that they were legally married by the time

of the borrower’s death.

§ Have lived since the beginning of the loan, and continue to live, in the

home as their principal residence.

§ Provide their Social Security number or Tax Identication Number.

§ Agree that they will no longer receive any payments from the reverse

mortgage loan.

§ Continue to meet all loan obligations, including paying property taxes and

homeowners insurance.

§ Ensure that the reverse mortgage loan does not become due and payable

for any other reason.

15

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

Tip

If you live with a Non-Borrowing Spouse, consider:

§ Gathering all documents that support your spouse's claim of being

an Eligible Non-Borrowing Spouse. These documents may include a

marriage certicate and property deed.

§ Seeking legal advice if you believe your spouse should be on

the loan. If your spouse is not on the loan, talk to a lawyer about

transferring the property to your spouse when you die.

If you have heirs

If your heirs want to keep your home after you and your spouse die, they

will have to repay either the full loan balance or 95 percent of the home’s

appraised value – whichever is less.

Talk to your heirs now. Prepare for any non-borrowing family members living

in the home by deciding what they will do after you die.

16

How to get help

If you’re having trouble with your reverse mortgage, here’s what you can do to

get help:

§ As a borrower you have a right to request information from or dispute any

errors with your lender or servicer. To learn more got to, consumernance.

gov/askcfpb/1855.

§ Consult an attorney. If you need help nding an attorney, visit your local or

state bar. You may qualify for free legal services. To nd a legal aid ofce, go

to lsc.gov.

§ Talk to a housing counselor. HUD-approved housing counseling agencies

offer free or low-cost expert assistance. You can nd a housing counseling

agency by going to hud.gov or calling (800) 569-4287.

§ Reach out to Area Agencies on Aging (AAA) to nd state and local assistance

programs that may be able to help you pay for property charges or needed

home repairs. To nd the nearest AAA, call (800) 677-1116 or visit eldercare.

acl.gov.

§ Submit a complaint with the CFPB if you are having problems with your

lender or servicer by going to consumernance.gov or by calling toll-free

(855) 411-CFPB (2372).

§ Find more information on reverse mortgage issues at consumernance.gov/

reversemortgage.

17

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES18

Glossary

DEFINED TERM DEFINITION

Appraisal A written document that shows an opinion of how

much a property is worth. It describes what makes the

property valuable and may show how it compares to

other properties in the neighborhood.

Co-borrower A person, usually your spouse or partner, who also signs

the reverse mortgage loan note and who is equally

responsible for fullling all the loan obligations and who

also receives the benets from the loan.

Deed-in-lieu of

foreclosure

An arrangement where you voluntarily turn over

ownership of your home to the lender to avoid the

foreclosure process.

Default The failure to meet the loan requirements included in

the reverse mortgage. For example, the requirements

of a Home Equity Conversion Mortgages (HECM) loan

include occupying the home as the principal residence,

keeping the home in good repair, and paying the

property charges on-time. A borrower’s failure to full

these obligations would cause the loan to default and

may lead to foreclosure.

Eligible Non-

Borrowing

Spouse

A borrower’s spouse who is not a co-borrower, but

qualies under HUD’s rules to stay in the home after the

borrower has died.

Equity

The amount your property is currently worth, less the amount

owed on any existing mortgages on your property.

19

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

DEFINED TERM DEFINITION

Federal Housing

The federal agency that insures HECMs, the most

Administration

common type of reverse mortgage loan. FHA is a

(FHA)

part of the U.S. Department of Housing and Urban

Development (HUD).

The process where the lender takes back property

because the borrower no longer fullls the obligations

Foreclosure

of the reverse mortgage loan. Foreclosure processes

differ by state.

Home Equity

The most common type of reverse mortgage today.

Conversion

One way they differ from private reverse mortgages

Mortgage

(sometimes called “proprietary” reverse mortgages) is

(HECM)

that HECMs are federally insured by the FHA.

Pays for losses and damage to your property if

something unexpected happens, like a re or burglary.

Standard homeowners insurance doesn’t cover damage

from earthquakes or oods, but it may be possible

Homeowners

to add this coverage. Homeowners insurance is also

Insurance

sometimes referred to as "hazard insurance." Borrowers

with a HECM loan are required to maintain homeowners

insurance in addition to, the mortgage insurance also

required with a reverse mortgage loan.

HUD-Approved

An organization with housing counselors that are

Housing

approved by HUD. Borrowers taking out a HECM

Counseling

reverse mortgage loan must receive counseling from a

Agency

HUD-approved reverse mortgage counseling agency

before receiving the loan.

20

DEFINED TERM DEFINITION

The nancial institution that loaned the borrower

Lender

money.

Loss Mitigation

The steps mortgage servicers take to work with a

borrower to avoid foreclosure. Loss mitigation refers

to a servicer’s responsibility to reduce or “mitigate” the

loss to the investor that can come from a foreclosure.

Certain loss mitigation options may help you stay

in your home. Other options may help you leave

your home without going through foreclosure. Loss

mitigation options for reverse mortgage borrowers

may include deed-in-lieu of foreclosure or a

repayment plan.

The lesser of the appraised value of the home, the

sales price of the home being purchased, or the

Maximum Claim

maximum limit HUD will insure. The maximum claim

Amount

amount is one factor used to calculate how much a

homeowner can borrow with a reverse mortgage loan.

Mortgage

Insurance Premium

An initial and annual amount charged by the lender

and paid to the Federal Housing Administration.

Mortgage insurance is in addition to the homeowners

insurance the borrower must maintain.

A one-time upfront fee that the lender charges the

borrower for making the loan. These fees are limited

Origination Fees

by the maximum claim amount and may not exceed

$6,000.

21

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

DEFINED TERM DEFINITION

Principal Limit

The amount of money the borrower can borrow with a

reverse mortgage loan. The principal limit for a HECM

is calculated using the age of the youngest borrower or

Eligible Non-Borrowing Spouse, the interest rate on the

loan, and the maximum claim amount. The principal

limit generally will increase each month, possibly making

additional funds available for borrowers with adjustable

rate HECMs, but not xed-rate HECMs. In general, loans

with older borrowers, higher-priced homes, and lower

interest rates will have higher principal limits than loans

with younger borrowers, lower-priced homes, and

higher interest rates.

Principal

Residence

The dwelling where the borrower, and if applicable,

the Non-Borrowing Spouse, maintains their permanent

home and where they typically spend the majority

of the year. A borrower may only have one principal

residence at a time. If the borrower moves someplace

else for a majority of the year, or to a nursing or assisted

living facility for more than 12 consecutive months, the

borrower must pay back the reverse mortgage loan.

Reverse mortgage loans that are not insured by the

Proprietary

federal government and are typically designed for

Reverse

borrowers with higher home values than those insured

Mortgage

by HUD.

22

Notes

23

YOU HAVE A REVERSE MORTGAGE: KNOW YOUR RESPONSIBILITIES

Notes

24

W ebsite

consumernance.gov/reversemortgage

General inquiries

Consumer Financial Protection Bureau

1700 G Street NW

Washington DC 20552

S ubmit a complaint by phone

855-411-CFPB (2372);

TTY/TDD 855-729-CFPB (2372)

Submit a complaint online

consumernance.gov/complaint

Consumer Financial

Protection Bureau

March 2020