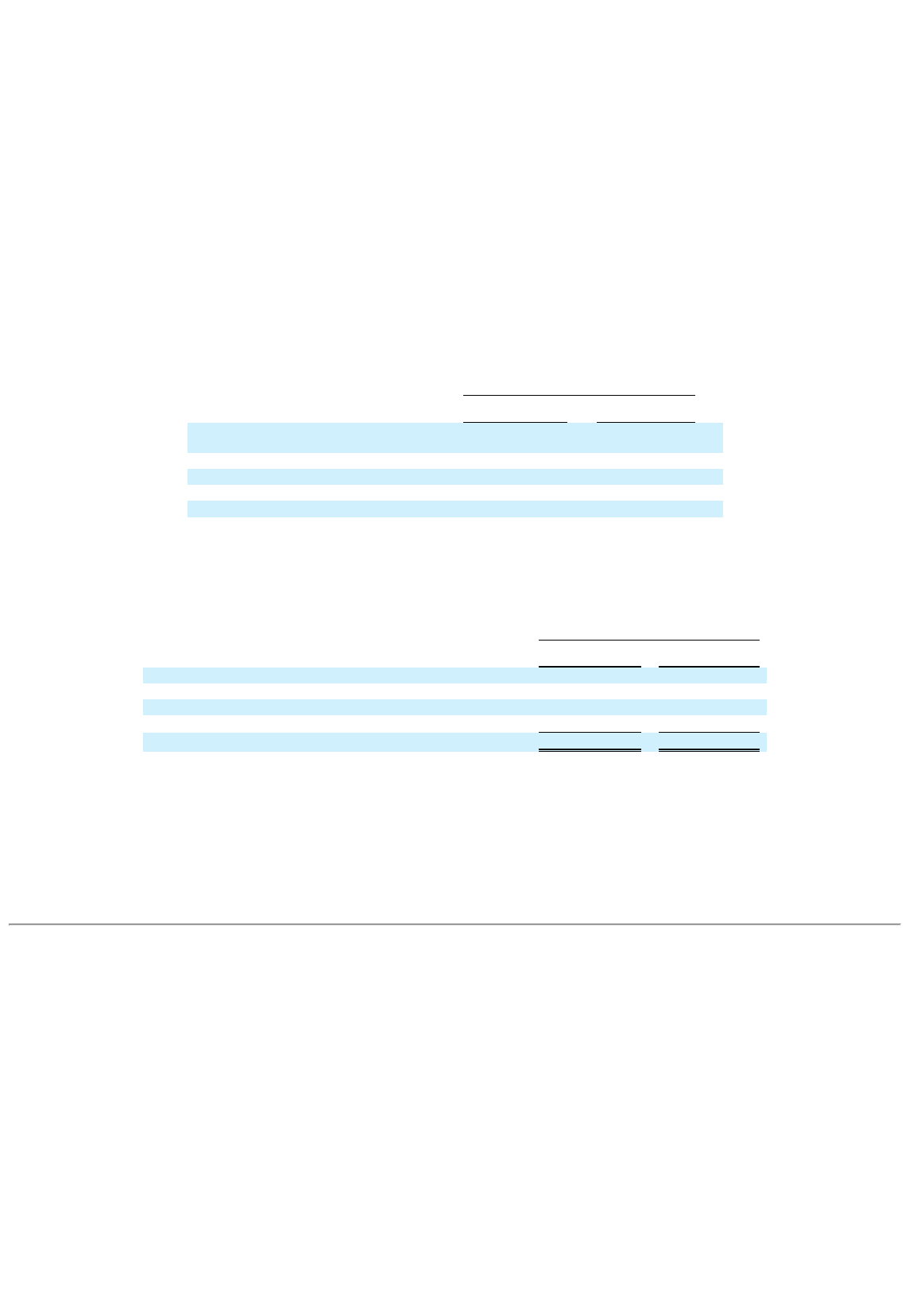

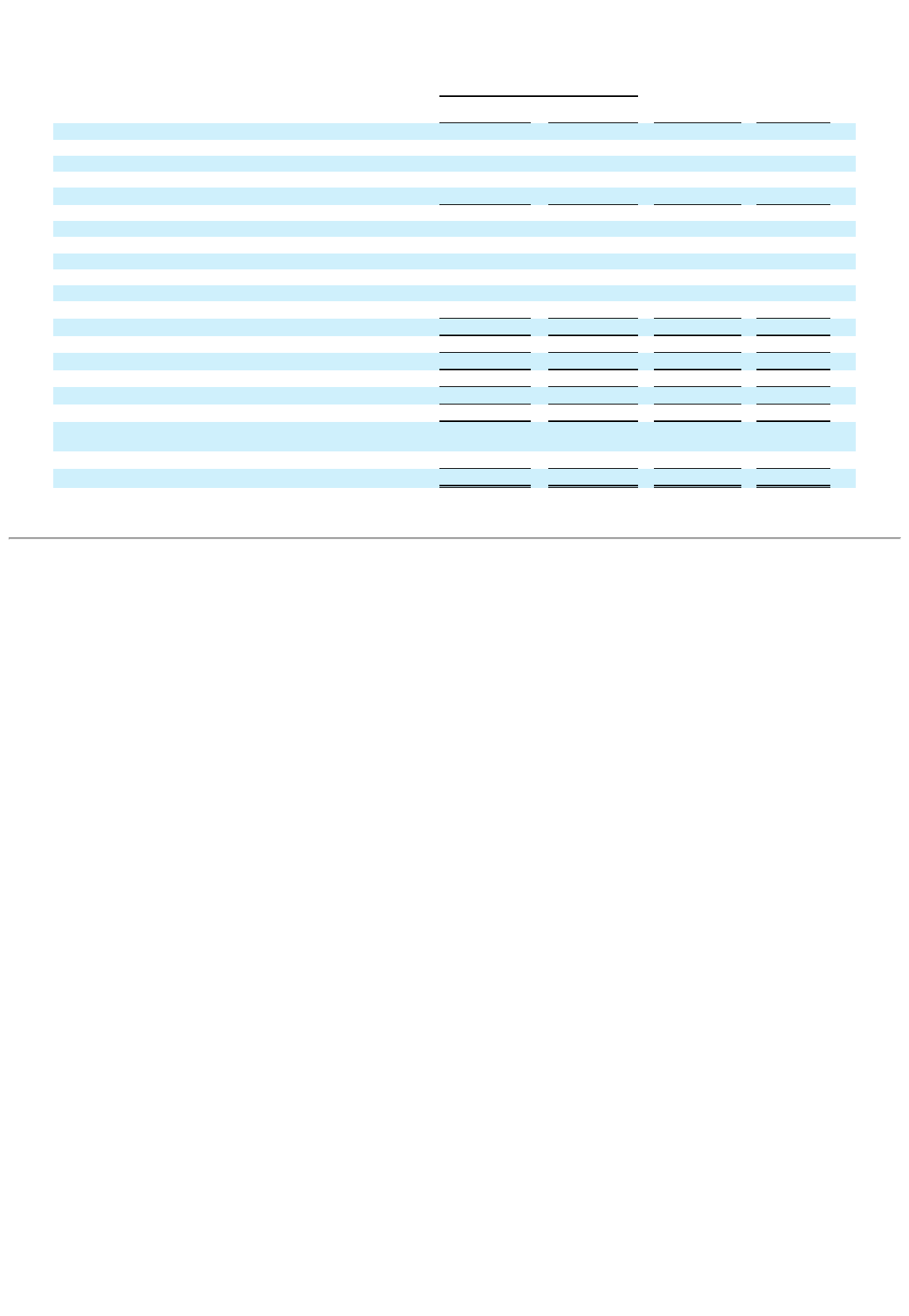

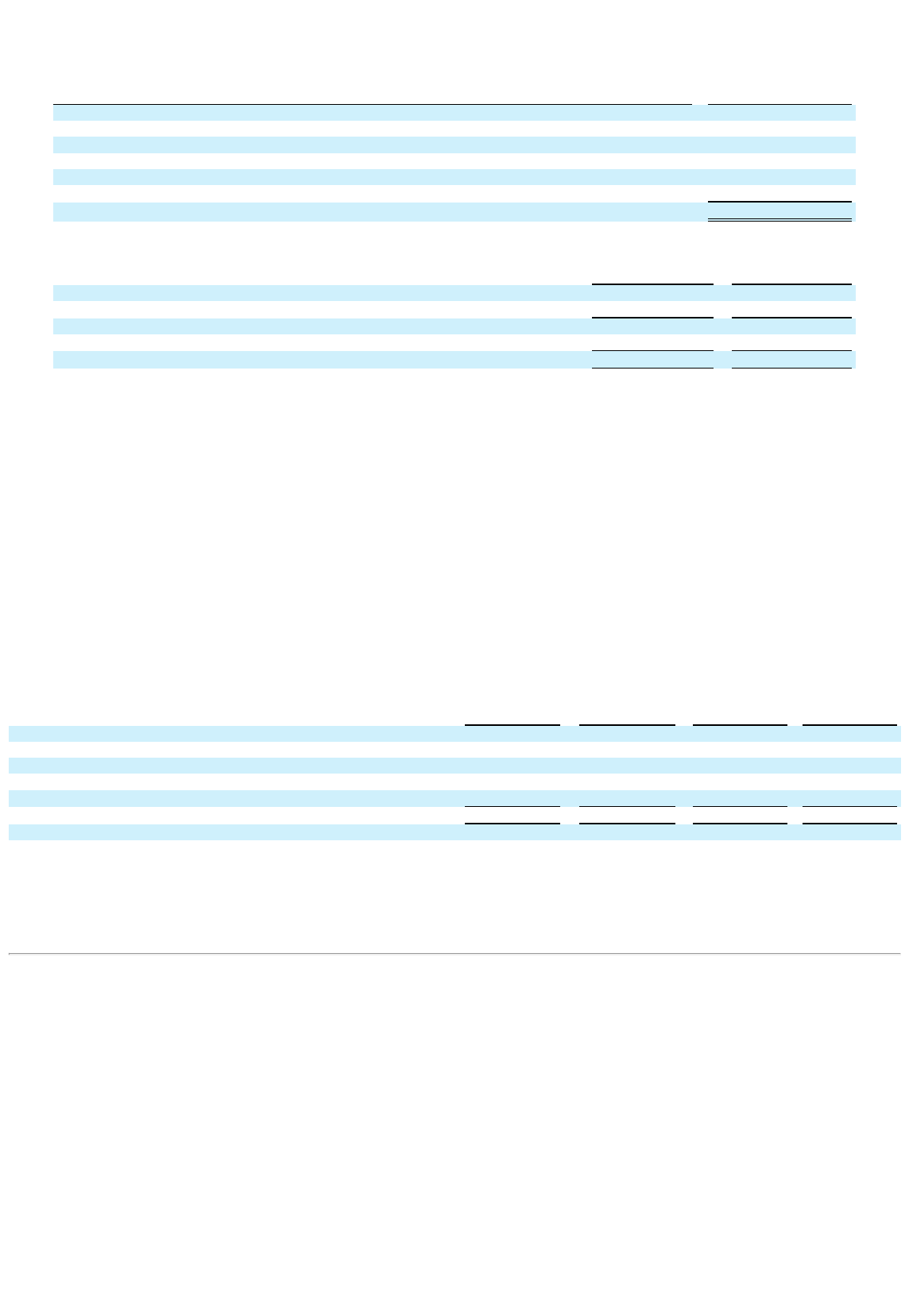

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 25, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION

PERIOD FROM TO

Commission File Number 001-40714

EUROPEAN WAX CENTER, INC.

(Exact name of Registrant as specified in its Charter)

Delaware 86-3150064

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

5830 Granite Parkway, 3 Floor

Plano, Texas

75024

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (469) 264-8123

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

Trading

Symbol(s) Name of each exchange on which registered

Class A common stock, par value $0.00001 per share EWCZ The Nasdaq Stock Market LLC

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the

definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

☐

Accelerated filer

☐

Non-accelerated filer

☒

Smaller reporting company

☐

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section

404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the Registrant's Class A common stock held by non-affiliates, based on the closing price of the shares of Class A common stock as reported on The Nasdaq Stock

Market LLC on December 23, 2021, was $613.9 million. The Registrant elected to use December 23, 2021 as the calculation date because on June 26, 2021 (the last business day of the

Registrant’s second fiscal quarter), the Registrant was a privately held company and it was the closest trading day prior to the Registrant's fiscal year-end.

As of March 10, 2022, the registrant had 37,032,423 and 26,433,636 shares of Class A and Class B common stock, respectively, $0.00001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its annual meeting of stockholders to be held on June 8, 2022 are incorporated by reference into Part II and Part III of this Form 10-K.

rd

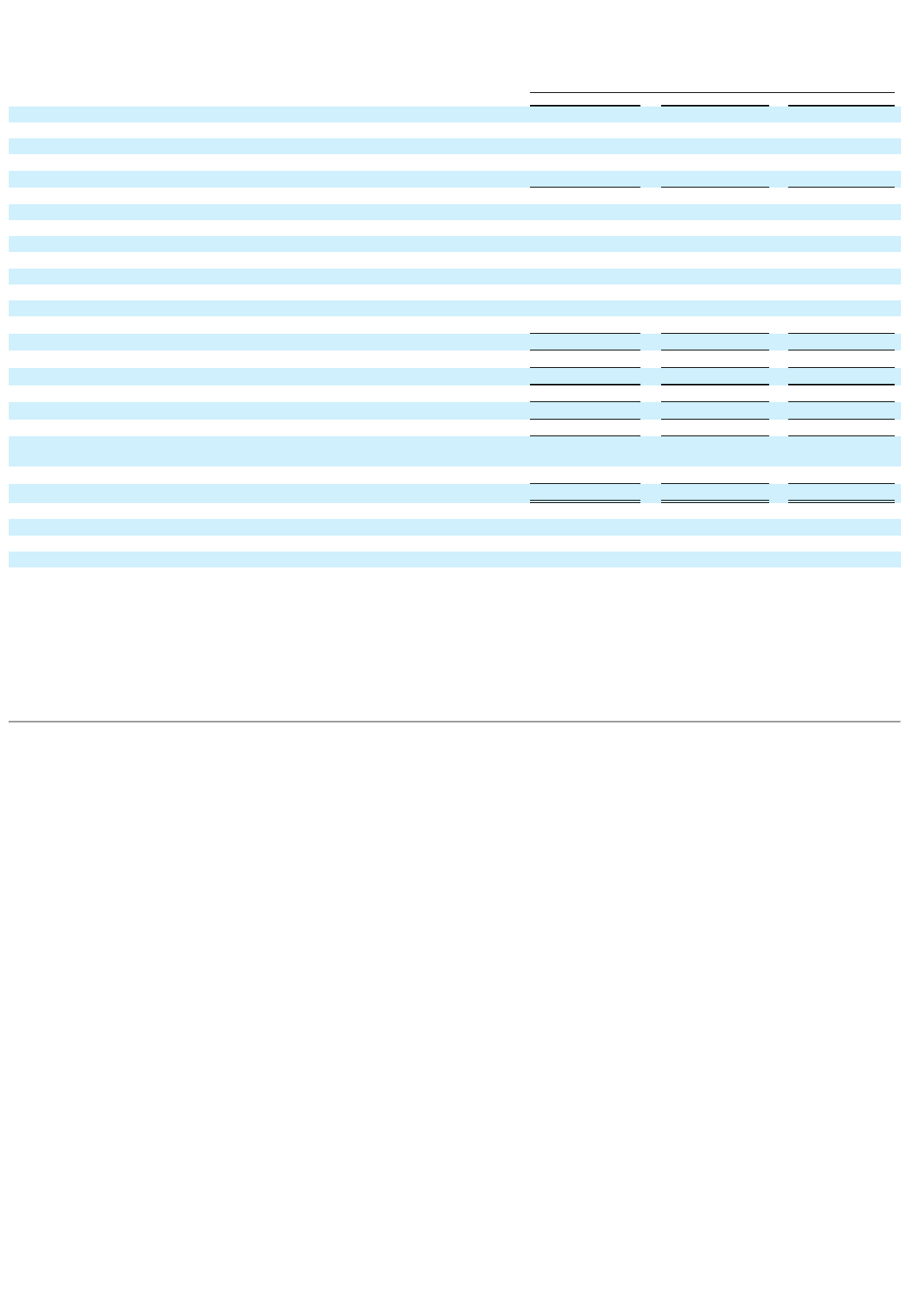

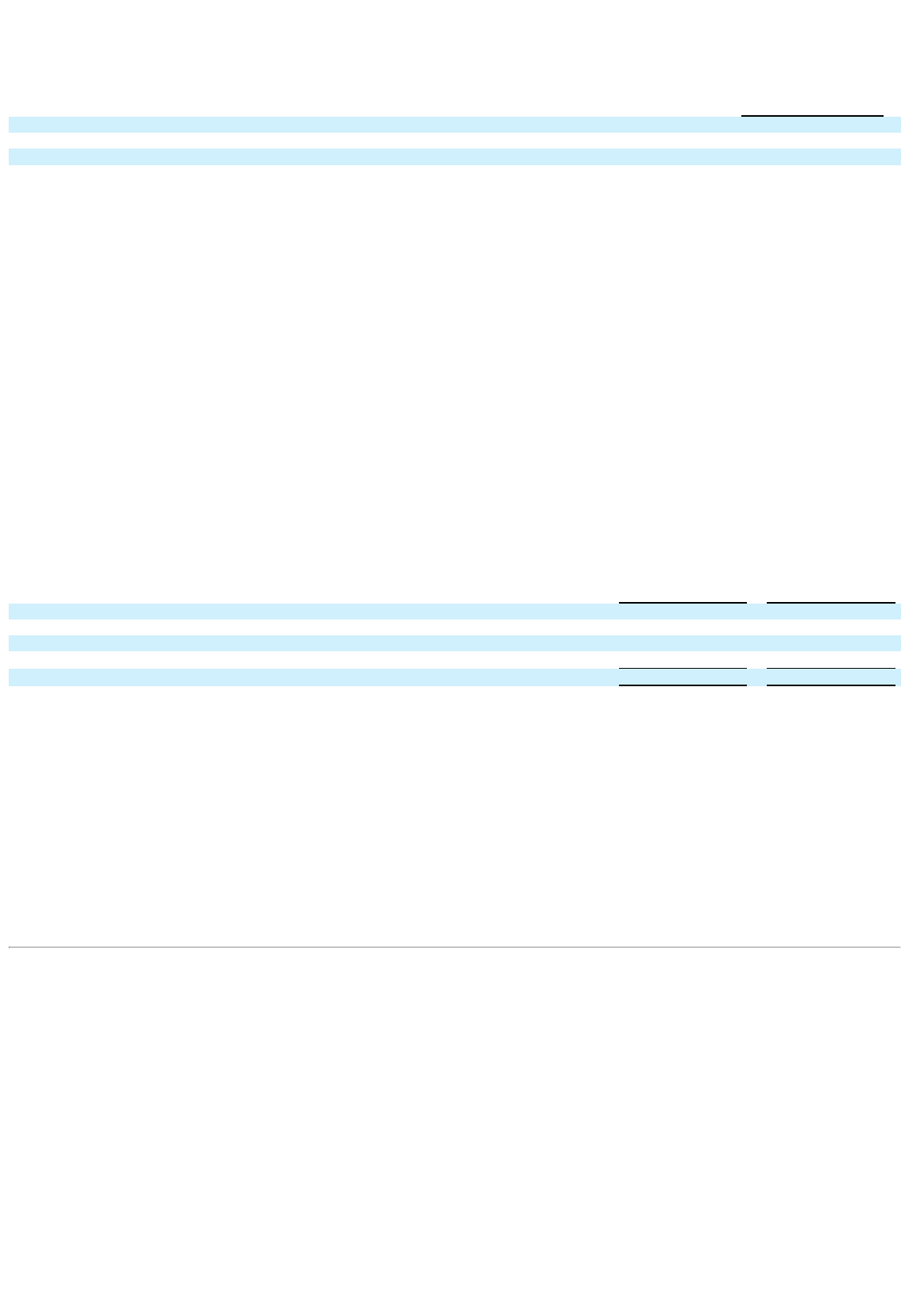

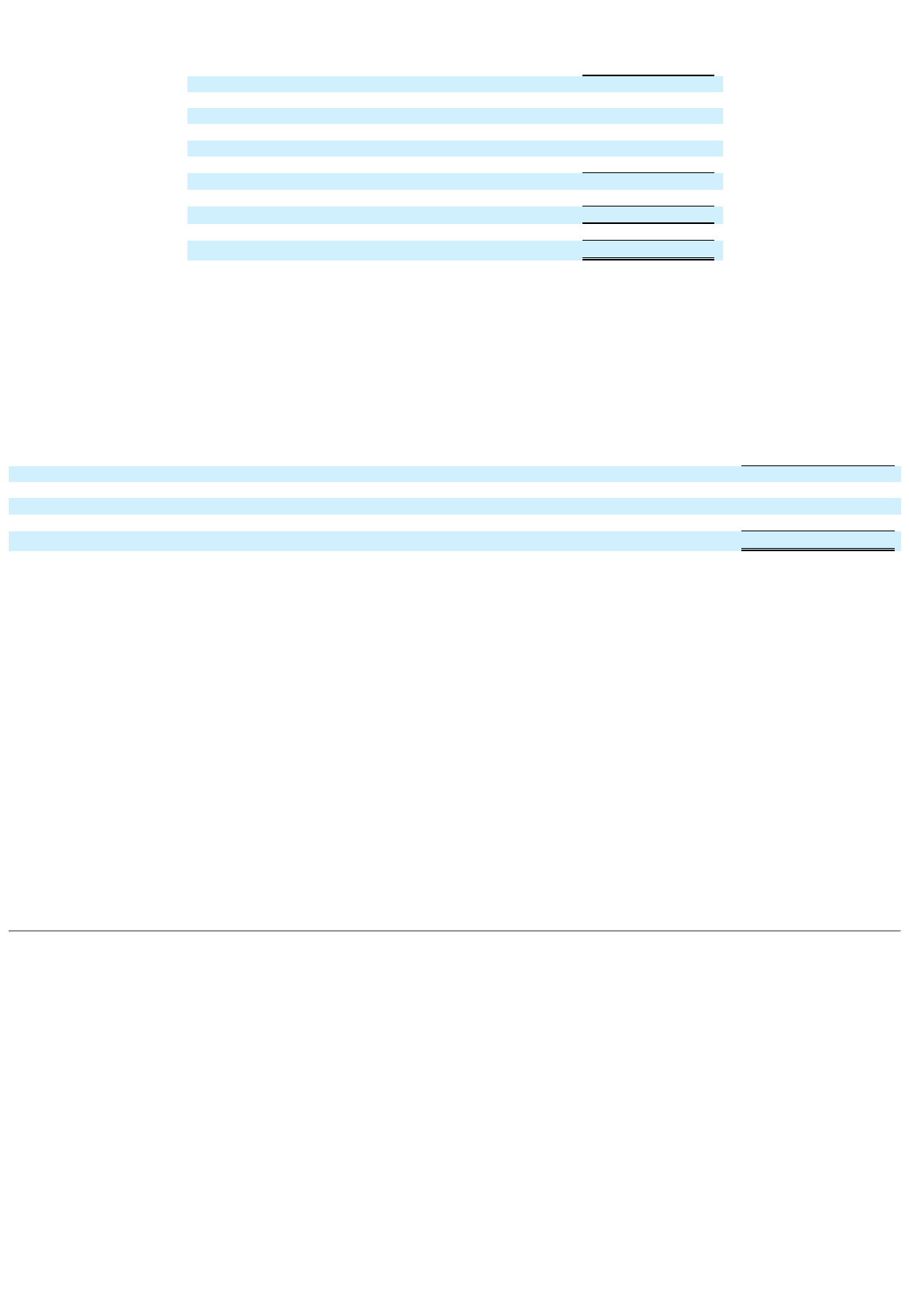

Table of Contents

Page

PART I

Item 1. Business 1

Item 1A. Risk Factors 9

Item 1B. Unresolved Staff Comments 40

Item 2. Properties 40

Item 3. Legal Proceedings 40

Item 4. Mine Safety Disclosures 41

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities 42

Item 6. Reserved. 43

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations 43

Item 7A. Quantitative and Qualitative Disclosures About Market Risk 59

Item 8. Financial Statements and Supplementary Data 60

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure 90

Item 9A. Controls and Procedures 90

Item 9B. Other Information 90

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections 90

PART III

Item 10. Directors, Executive Officers and Corporate Governance 91

Item 11. Executive Compensation 91

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 91

Item 13. Certain Relationships and Related Transactions, and Director Independence 91

Item 14. Principal Accounting Fees and Services 91

PART IV

Item 15. Exhibits, Financial Statement Schedules 92

Item 16. Form 10-K Summary 93

i

PART I

Item 1. Business.

Overview

We are the largest and fastest-growing franchisor and operator of out-of-home ("OOH") waxing services in the United States by number of centers and

system-wide sales. We delivered over 21 million waxing services in 2019, over 13 million waxing services in 2020 and over 20 million waxing services in

2021 generating $687 million, $469 million and $797 million of system-wide sales, respectively, across our highly-franchised network. We have a leading

portfolio of centers operating in 853 locations across 44 states as of December 25, 2021. Of these locations, 848 are franchised centers operated by

franchisees and five are corporate-owned centers.

The European Wax Center brand is trusted, efficacious and accessible. Our culture is obsessed with our guest experience and we deliver a superior guest

experience relative to smaller chains and independent salons. We offer guests high-quality, hygienic waxing services administered by our licensed, EWC-

trained estheticians (our “wax specialists”), at our accessible and welcoming locations (our “centers”). Our technology-enabled guest interface simplifies

and streamlines the guest experience with automated appointment scheduling and remote check-in capabilities, ensuring guest visits are convenient, hassle-

free, and consistent across our network of centers. Our well-known, pre-paid Wax Pass program makes payment easy and convenient, fostering loyalty and

return visits. Guests view us as a non-discretionary part of their personal-care and beauty regimens, providing us with a highly predictable and growing

recurring revenue model.

Our asset-light franchise platform delivers capital-efficient growth, significant cash flow generation, and resilience through economic cycles. Our centers

are 99% owned and operated by our franchisees who benefit from superior unit-level economics, with mature centers generating annual cash-on-cash

returns in excess of 60%.

In partnership with our franchisees, we fiercely protect our points of differentiation that attract new guests, build meaningful relationships and promote

lasting retention. We are so confident in our ability to delight that we have always offered all of our guests their first wax free.

Our Recent Financial Performance

Financial Performance in 2019

During 2019, we administered more than 21 million services and grew our center count to 750. We generated $687 million of system-wide sales and $154

million of net revenue. Net loss was $24 million and Adjusted EBITDA was $34 million in 2019.

Performance in 2020 and During the COVID-19 Pandemic

In January and February 2020, our performance continued with the same momentum experienced in 2019, with same-store sales growth of 11.1% and

10.8%, compared to the prior year periods. At the onset of the pandemic in March 2020, however, all of our centers temporarily closed due to the

implementation of certain mandated closure requirements across the United States. In response to the pandemic, our management team developed and

executed a detailed response plan focused on raising our already industry-leading hygiene standards and ensuring the safety of our guests, franchisees and

associates.

By May 2020, our centers began to re-open as local health and safety guidance allowed and we saw an immediate rebound in performance. While the

trajectory of our same-store sales performance fluctuated during the second half of 2020 in conjunction with state-specific loosening or tightening of

COVID-19 restrictions in response to subsequent waves of COVID-19, our overall recovery demonstrates our guests consistently wanted to get back to

their regular waxing routines at European Wax Center. By March 2021, nearly all of our nationwide network had re-opened and we were generating

system-wide sales of approximately 101% of what they had been in March 2019 suggesting a nearly complete rebound from COVID-19 impacted

performance in 2020. 87% of the 52 opened centers came from our existing franchise base, reinforcing our network’s belief in the stability and future

success of our brand. During 2020, despite the challenges from COVID-19, our platform delivered strong growth in new centers as well as resilience in

revenues and profit margins. All corporate-owned centers had re-opened as of December 26, 2020.

• Center count increased from 750 in 2019 to 796 in 2020;

• System-wide sales decreased from $687 million in 2019 to $469 million in 2020;

• Net revenue decreased from $154 million in 2019 to $103 million in 2020;

• Net loss decreased from $24 million in 2019 to $21 million in 2020; and

• Adjusted EBITDA decreased from $34 million in 2019 to $20 million in 2020.

1

Performance during 2021

As conditions resulting from the COVID-19 pandemic continued to improve, our platform delivered growth in revenue and profitability, as well as an

increase in new centers during fiscal year 2021. As of December 25, 2021 all of our centers had reopened, and we expect that our future financial results

will continue to strengthen as COVID-19 related capacity restrictions were lifted and guests are able to return to our centers at full capacity levels.

• Center count increased from 796 as of December 26, 2020 to 853 as of December 25, 2021;

• System-wide sales increased from $469 million in fiscal year 2020 to $797 million in fiscal year 2021;

• The Company’s total revenue increased from $103 million for the year ended December 26, 2020 to $179 million for the year ended

December 25, 2021;

• Consolidated net income improved from a net loss of $21 million in 2020 to net income of $4.0 million in 2021; and

• Adjusted EBITDA increased from $20 million for the year ended December 26, 2020 to $64 million for the year ended December 25,

2021.

Our Growing Market Opportunity

Hair removal is an integral and recurring part of the personal-care and beauty regimens for most women and many men in the United States, and hair

removal solutions are consistently in demand, given the recurring nature of hair growth.

We estimate that our $18 billion total addressable domestic market includes approximately 69 million U.S. adults who are currently waxing or are

interested in waxing. The OOH waxing market, in which European Wax Center competes, is the fastest growing hair removal alternative and grew at an

estimated compound annual growth rate ("CAGR") of 8% between 2015 and 2019, compared to an estimated CAGR of 3% over the same time period for

the total hair removal market.

Although European Wax Center currently represents only 4% of our addressable market, we estimate we are approximately six times larger than our closest

waxing-focused competitor within OOH waxing by center count and approximately 13 times larger by system-wide sales. Our market remains highly

fragmented, with more than 10,000 independent waxing-focused operators that lack scale and almost 100,000 beauty salons that only provide waxing as a

small part of their broader service offering. For many beauty salons and other similar operators, waxing is not their core competency, with services

frequently provided in “backrooms” and without significant investment in the overall experience. This fragmentation results in a marketplace characterized

by inconsistent quality, lack of technological accessibility and scheduling, and one-time transactional services that fail to instill customer trust and

engagement. European Wax Center’s singular focus on waxing services and unmatched scale allow us to capitalize on this opportunity.

Our Differentiated Brand Experience

We believe our approach to OOH waxing has revolutionized the category. Our brand experience is differentiated because we are:

• Experts in Wax: Our service model is focused exclusively on wax-based hair removal. We obsess over every element of the waxing services we

deliver for our guests:

• Expert Line-up of Waxing Services & Products: We provide a comprehensive assortment of body and facial waxing services using our

Comfort Wax formulation, which features a unique blend of the highest quality natural beeswax combined with other skin-soothing

ingredients for the most comfortable waxing experience. We provide a line of proprietary pre- and post-service products, including ingrown

hair serums, exfoliating gels, brow shapers and skin treatments, which ensure the full benefits of the waxing experience are realized by our

guests.

• Expert Training of our Licensed Wax Specialists: Our franchisees employ over 8,000 licensed, highly-trained and knowledgeable wax

specialists committed to delivering an exceptional guest experience. In addition to being licensed, every EWC wax specialist must

successfully complete our proprietary training program to ensure consistency and quality of service for every guest. Our wax-focused

education modules provide time-intensive training that substantially builds upon cosmetology licensing programs. We view our training as a

key competitive differentiator enabling guests to receive a consistent service delivery regardless of the wax specialist with whom they are

scheduled. Through the delivery of personalized services and education about the benefits of regular waxing, our wax specialists help

strengthen guest loyalty to our brand.

• Expert Hygiene and Safety Standards: We adhere to the highest safety and hygiene standards in the industry. We from time to time engage

third-party safety experts to review and enhance our hygiene protocols. Wax Specialists utilize disposable gloves and masks to administer

services and we strictly adhere to single use wax applicator protocols (we never double dip the applicator blades in wax pots). Our wax

suites are sanitized and disinfected after each guest visit. In addition, our centers are equipped with socially-distanced seating arrangements

and multiple sanitary stations, and our mobile app facilitates a contactless experience with self-check-in.

2

• Champions of Confidence and Guest Experience: According to consumer surveys, our guests feel better and more confident after a service

visit at one of our centers. We have focused on enhancing the guest experience across all touchpoints within our brand:

• Champions of Accessibility: Our growing network of 853 centers across 44 states enables convenience and accessibility for our customers.

Whether our guests move across town or across the country, our brand can serve their ongoing waxing needs with more access points than

any other provider of OOH waxing services in the United States. Our Wax Pass program is portable across our network and guests often

redeem services through a Wax Pass across multiple European Wax Center locations. Our mobile app technology further enhances

accessibility by enabling guests to easily book appointments on-line at a time and location most convenient to them.

• Champions of the In-Center Experience: Our in-center atmosphere is designed to be refined, clean and easy to use, with mobile app self-

check-in available at all centers. Our lobby features an inviting product wall with take-home sampling. Our guests can choose to wait for

their appointment in their car until a text alerts them to walk directly to their designated suite where their wax specialist awaits. Our iPad-

equipped suites provide our wax specialists with detailed insights on each of their guests, empowering them to personalize product

recommendations, for example.

• Champions of Guest Retention and Repeat Visits: We encourage guests to schedule future visits on a regular basis and reward them for

their use of our pre-paid Wax Pass program. We believe Wax Pass holders visit us more frequently, have meaningfully higher retention rates

and represent our most valuable guests. Additionally, we expect to further amplify our guest experience and drive retention with our EWC

Rewards Loyalty Program that launched in October 2021.

Our Competitive Strengths

We attribute our success to the following strengths that we believe provide us with a competitive advantage in our industry:

Trusted National Brand that Inspires Confidence

We believe revealing beautiful skin is the first step to revealing one’s best self, and our brand stands for delivering unapologetic confidence to our guests.

Waxing is an intimate experience, and our guests seek a dependable, safe, and clean setting with a professional wax specialist they trust. Our unmatched

scale provides us with a nationwide footprint to serve our loyal guest base wherever they may be. Our singular commitment to delivering best-in-class

service is reinforced by our marketing efforts driving national brand awareness and consideration. We are so confident in our ability to delight that we have

always offered all our guests their first wax free.

Committed Franchisees Achieving Attractive and Predictable Unit-Level Economics

Our simple, yet difficult to replicate, operating model translates into an attractive return on our franchisees’ invested capital. Our high-quality franchisee

base consists of 239 franchisees as of December 25, 2021, with 159 franchisees operating multiple European Wax Center locations. Our centers require a

modest upfront investment cost, then rapidly achieve profitability and generate superior unit-level economics. We generate revenue from our franchisees

through the sale of branded products as well as the payment of ongoing fees, including royalty and marketing fund contributions, which are determined by

the service sales of each center. For the year ended December 25, 2021, we received revenue from our franchisees as follows: $99.7 million, or 58%, of our

revenue came from product sales, $43.6 million, or 25%, of our revenue through franchisee royalty payments, $24.6 million, or 14%, of our revenue

through marketing fund contributions, and $4.6 million, or 3%, of our revenue came from other sources. Our remaining revenue for the year ended

December 25, 2021 was generated from corporate-owned centers.

Our centers experience a highly predictable maturation curve that is consistent across cohorts and geographies, providing our franchisees with a high

degree of confidence in realizing attractive returns. We believe our value proposition has created a franchisee base that is committed to growing with our

brand, with more than 79% of new centers opened in 2019, 87% of new centers opened in 2020 and 93% of new centers opened in 2021 coming from

existing franchisees.

Recurring Nature of Services Combined with Scaled Footprint and Consistent Demand Drives Revenue Predictability

Hair removal is an integral part of the personal-care and beauty regimens for most women and many men in the United States. Given the recurring nature

of hair growth, hair removal solutions are regularly in demand and our guests trust European Wax Center to meet their routine hair removal needs. Our

national scale and exclusive focus on wax-based hair removal enables us to provide a highly consistent waxing experience across each of our centers. The

reliability of our guest experience ensures consistent demand for our services, which drives uniform unit-level economics for our franchisees which in turn

drives revenue predictability for European Wax Center. We further facilitate repeat visits through the use of our pre-paid Wax Pass program, which we

believe promotes meaningfully higher guest retention rates.

3

Asset-Light Franchise Platform with Resilient Free Cash Flow Generation

Our asset-light franchise platform delivers capital-efficient growth, significant cash flow, and resilience through economic cycles. Due to the impacts of

COVID-19, including the temporary closure of all of our centers, our networks experienced the first year of negative same-store sales growth in 2020.

However, positive same-store sales growth, calculated against both 2020 and 2019, resumed in 2021. In addition, given our low capital expenditures and

working capital needs, we are able to drive strong free cash flow generation throughout economic cycles. In 2020, for example, through disciplined cost

management, our business remained profitable on an EBITDA basis and sustained strong EBITDA margins despite the decline in system- wide sales driven

by the COVID-19 pandemic. Our ability to drive robust financial performance through 2020 is a testament to the resilience of our platform, which enables

us to invest in technology and digital enablement, training programs, and marketing initiatives. This is a key differentiator of our scaled platform relative to

independent operators in our market, and a significant reason why we believe we are the franchisor of choice in OOH waxing.

Experienced and Passionate Management Team Investing in the Next Phase of Our Growth

We are led by a best-in-class management team and our culture of performance, success and inclusivity is established by our CEO David Berg, who

previously served as the CEO of Carlson Hospitality and has extensive retail, hospitality and franchising experience. Since joining us in 2018, Mr. Berg has

led the acceleration of our center growth, the expansion of our franchisee network and our heightened cultural obsession with guest satisfaction.

The other members of our leadership team have been assembled at European Wax Center from senior positions at leading organizations including Sally

Beauty, Luxottica, Jamba Juice, and American Eagle Outfitters. Our team has encouraged investment in tech-forward systems and corporate infrastructure

to support the anticipated continued growth of our network. We believe our guests and franchisees are better connected with one another as a result of our

scale advantages and we are only in the early innings of truly unlocking the potential of our unique platform.

Our Growth Strategies

We intend to deliver sustainable growth in revenue and profitability by executing on the following basic strategies:

Grow Our National Footprint Across New and Existing Markets

We believe our franchisees’ track record of successfully opening new centers and consistently generating attractive unit-level economics validates our

strategy to expand our footprint and grow our capacity to serve more guests. Our center count grew 7%, 6% and 5% during fiscal years 2021, 2020 and

2019, respectively, and has grown every year since 2010. Our thoughtful approach to growth ensures each center is appropriately staffed with the high-

quality team and licensed, highly trained wax specialists that our brand has been known for since our initial opening.

We believe that none of our existing markets are fully penetrated and approximately 75% of our whitespace opportunity is in markets where we already

have a presence today, which provides us with a high degree of confidence for the likely receptivity and success of new openings.

Our new centers require a modest upfront investment and follow a highly predictable maturation curve across cohorts and geographies, providing us and

our franchisees with a high degree of visibility into the embedded earnings potential of newly opened centers. Historically, our centers reach maturity after

five years, and as of December 25, 2021, 67% of our centers were mature.

Continue to Grow Our Brand Awareness and Accelerate Our Guest Acquisition

We believe that influential consumer trends will continue to expand the market for OOH waxing and that the OOH market will continue to take share from

alternative hair removal solutions. Although our brand is nationally recognized, there are still significant opportunities to further drive brand awareness to

attract new guests while increasing engagement of existing guests through increased visit frequency and spend.

To drive brand awareness with all consumers, we employ several strategies, including:

• Performance marketing: We deploy data-driven marketing dollars across multiple forms of media with an attractive return on advertising

spend;

• Digital content: We partner with select digital media content creators and social media influencers, thereby encouraging positive testimonials

from our guests; and

• Market densification: We are strategically densifying existing target markets with new centers thus increasing regional brand awareness and

word-of-mouth referrals.

Employ Strategies to Continue Driving Same-Store Sales Growth

We are continuously employing strategies to increase guest visit frequency and drive higher guest spend with the aim of sustaining our same-store sales

growth, including:

4

• Increase Wax Pass Adoption Rates: Our Wax Pass program provides guests with preferential pricing through either pre-paid or unlimited wax

passes and provides us with a recurring and predictable revenue stream. We continue to expand and refine the program to drive increased

adoption from non- member guests and we have grown the share of transactions conducted using Wax Passes to more than 57% in 2021.

• Expand our Share of our Guests’ Personal-Care Expenditures: The trusted relationships between guests and wax specialists results in an

authentic channel through which we can increase our share of our guests’ spend on personal-care. Over time, we believe the relationship

between guest and wax specialist provides us a strong foundation to broaden our offerings across the personal-care category.

• Increase our Transaction Attachment Rate: Approximately 14%, 15% and 11% of transactions in 2021, 2020 and 2019, respectively, resulted in

purchases of retail products. In April 2021, we launched a refreshed portfolio of retail products complementing our core waxing services across

all centers. We expect to drive greater attachment rates from this new product line-up through the right product innovation, attractive pricing, and

expert consultative selling by our trained wax specialists. We define the term “attachment rate” as the percentage of transactions that include the

purchase of a retail product to the total number of transactions.

• Drive Greater Guest Engagement Using Data Analytics: We are continuously developing new use cases from our guest database. As our data

capabilities mature, we believe we will learn more about our guests’ preferences and behaviors, unlocking more high-quality interaction

opportunities. We are in the process of expanding our advanced data analysis capabilities to improve guest visit frequency and loyalty by

deploying timely and hyper-personalized communications and relevant reminders to our guests.

Expand Our Profit Margins and Generate Robust Free Cash Flow

We have invested in building our scalable support infrastructure, and we currently have the capabilities and systems in place to drive revenue growth and

profitability across our existing and planned franchise centers. Given our unmatched scale within the OOH waxing market, we can procure the highest

quality products and supplies used to administer our services at lower prices than smaller independent providers of the same services. We expect to

generate operating leverage given our fixed corporate cost structure, and we expect that incremental leverage, combined with our low capital expenditure

and working capital needs, will allow us to generate improved operating margins and robust free cash flow.

Our Guests

Approximately 96% of our guests are women, with our brand appealing to female guests across age groups, ethnicities and income brackets. At every

touchpoint, we embody our mission by concentrating key media communications on passion points that bolster guest affinity for European Wax Center and

deliver personalized messaging to inspire action. While we estimate that male waxing constitutes approximately 20% of our total addressable market, our

current guest base is only 4% male, representing an attractive growth opportunity. We believe there has been a significant increase in male interest in OOH

waxing over the past five years. We intend to increase our share of male guests, with specific male-focused marketing collateral and service offerings.

Our Centers

We have a leading portfolio of centers operating in 853 locations across 44 states as of December 25, 2021. Of these locations, 848 are franchised centers

operated by franchisees and five are corporate-owned centers.

On average, our centers are approximately 1,200 to 1,600 square feet with six to seven wax suites and are typically staffed with one wax specialist per suite

in addition to one or two guest service associates. Our centers are designed to provide a seamless guest experience from the moment our guests walk in, to

the moment they strut out of our centers. Upon entry, guests are greeted by a friendly service associate in a clean and modern lobby. The lobby offers

refined colors and textures that align with the European Wax Center brand ethos. Our guests can self-check-in through our mobile app, which increases the

swiftness of guest intake while allowing our team members to focus on servicing guests.

We ensure our centers offer socially distant seating and sanitation stations, underscoring our commitment to industry-leading hygiene and safety standards.

Once checked-in, our guests enter a private, sanitized waxing suite where wax specialists offer a personalized experience. In-suite iPads provide our wax

specialists with detailed insights on each of their guests, empowering them to provide “concierge-like” services such as personalized add-on services and

product recommendations, driving increased guest spend. After each service, our guests are encouraged to test our retail products with samples from our

touch-free sample bar, promoting our transaction attachment rate.

We continuously evaluate and enhance our center layout, imagery and cost build-out to ensure we have the best experience for our guests which drives

continued robust financial performance for our franchisees.

5

Center Selection Criteria

We have a scaled and diverse footprint with ample whitespace for center growth in new markets, as well as densification within our existing markets. Site

selection for new centers are typically proposed by our franchisees and reviewed and approved by European Wax Center as the franchisor. We determine

whether a site is appropriate for a European Wax Center location based on the condition of the premises, ease of access, visibility, proximity to other

centers, proximity to other competitive businesses, lease requirements, co-tenants, traffic patterns, demographics and population density, among other

factors.

Our Services and Retail Products

We offer our guests a variety of elevated body and facial waxing services focused on the most critical areas of their bodies needing hair removal. We also

offer skincare retail products to ensure that the full benefits of the waxing experience are realized by our guests.

Services

Our waxing services are administered by licensed wax specialists who are employed by our franchisees. In addition, prior to performing our services, our

wax specialists go through a rigorous, proprietary EWC training regime. Continuous training education is also a part of our ongoing operating plan to

ensure the highest quality service can constantly be delivered across our network of centers. Our wax specialists utilize our Comfort Wax formulation

during the waxing service. This wax product features a blend of the highest quality natural beeswax combined with other skin-soothing ingredients and is

co-manufactured for us by suppliers in Europe. Unlike other wax formulations, our wax is designed to specifically attach only to hair, not skin, providing a

differentiated and more comfortable waxing experience.

Retail Products

Our centers sell a comprehensive assortment of proprietary EWC-branded retail products that allow guests to maintain healthy post-wax skin between

visits. These products are specifically tailored to enhance the services we provide. Our products are dermatologist-tested and are formulated without

parabens, mineral oil, phthalates, hydroquinone, triclosan, formaldehyde and gluten. We exclusively distribute these retail products to our franchisees for

sale in-center and sell them direct-to-consumer through our website. We have approximately 34 full-sized SKUs in our branded product portfolio.

We partner with a leading co-manufacturer in North America to coordinate the manufacturing of our retail product offerings. While our suppliers support us

in formulation, sourcing, manufacturing, package development, safety testing and quality assurance, we own all of our retail product formulas and lead the

new product development processes to align our innovation capabilities with our strategic priorities.

Marketing Support

Based on our deep guest understanding and longevity in the OOH waxing market, we believe we have developed a highly effective marketing strategy that

is designed to promote awareness and consideration of our brand by new guests and encourage retention by existing guests.

We employ a variety of marketing techniques to build awareness of, and create demand for, our brand, and the services and products we offer. We have

implemented sophisticated data-driven marketing practices in support of this framework and we deploy the dedicated marketing funds contributed by our

franchisees across each of our marketing strategies. In 2019, we collected and spent approximately $20 million for marketing through our centralized

marketing fund, of which 61% was deployed through digital channels. Due to center closures in 2020 driven by the COVID-19 pandemic, we paused our

marketing fund collections from April 2020 to June 2020. As a result, we do not believe that the amounts collected and spent through our centralized

marketing fund in 2020 are representative of our historical or expected future marketing collections and spend. In 2021, we collected and spent

approximately $25 million for marketing through our centralized marketing fund, of which 44% was deployed through digital channels.

In addition to our corporate marketing strategy, many of franchisees choose to make additional investments in local marketing. We provide support to

ensure that their marketing aligns with our overall image and strategy.

Our Franchise Platform

Franchising Strategy

Our asset-light franchise platform delivers capital-efficient growth and our footprint expansion is supported by robust unit-level economics. Our simple, yet

difficult to replicate, operating model and the recurring nature of our services translates into an attractive return on invested capital for our franchisees. Our

centers require a modest upfront investment cost and follow a highly predictable maturation curve that is consistent across cohorts and geographies.

We are intentionally shifting toward a larger mix of multi-unit development agreements as we grow our footprint, which will allow for consistent and

efficient growth as we continue to scale.

6

Franchise Agreements

For each of our franchisees, we enter into a franchise agreement stipulating a standard set of terms and conditions. The initial term of a franchise agreement

is generally ten years, with the option to renew their agreements at expiration (ten-year renewal option). All proposed new center sites require formal

approval from us. Franchisees pay us an initial franchise license fee and franchise royalties typically based on a percentage of gross sales less the sale of

retail products. Franchisees also make contributions to our centralized marketing fund based on a percentage of gross sales less the sale of retail products.

Our franchise agreements set forth the requirements franchisees must comply with, including, but not limited to, our standard operational policies and

procedures that govern the provision of services and use of suppliers and require franchisees to purchase specified products from us and/or designated

suppliers. Franchisees are required to conform to our established operational policies and procedures relating to, among other things, quality of service,

training, center design and décor and trademark usage. Outside of these operational policies and procedures, we do not control the day-to-day operations of

franchised centers, including, but not limited to, employment, benefits and wage determination, establishing prices to charge for products and services,

business hours, personnel management and capital expenditure decisions. However, the franchise agreements afford us, as franchisor, certain rights,

including, but not limited to, the right to approve locations, suppliers and the sale of a franchise. Additionally, our field personnel make periodic visits to

franchised centers to ensure that they are operating in conformity with the operational policies and procedures for our franchising program. All of the rights

afforded to us with regard to franchised operations allow us to protect our brand, but do not allow us to control the day-to-day operations of franchised

centers or make decisions that have a significant impact on the success of franchised centers.

Franchise Support Services

We enjoy a strong partnership with our franchisees. To support their collective and individual success, we provide our franchisees with meaningful support

services including pre-opening support, guest experience support, and ongoing back-end support.

Pre-opening support:

• Site selection and approval: we work in partnership with our franchisees to ensure prospective new center locations are adequately vetted ahead

of any initial investment. Each franchisee is responsible for selecting a location but must ultimately obtain approval from us.

• Other pre-opening support: we conduct business reviews with each franchisee eight weeks prior to new center openings to ensure construction

activities are in sync with recruitment plans, training programs and all other pre-opening marketing activities to ensure each center is best

positioned to open successfully and build momentum.

Guest experience support:

• Wax training: we require an intensive six-day training program for all new wax specialists as well as continued learning requirements to keep all

wax specialists performing at the consistent, high-quality standards for which we are known. Training is conducted by a corporate or peer trainer

both in-person as well as virtually. Franchisees also appoint in-house trainers who are expected to maintain an ongoing training system for wax

specialists within each center.

• Hygiene protocols: our health and safety standards were industry-leading even before the COVID-19 pandemic and continue to be industry-

leading. We engage with independent safety experts to ensure our continued leadership and to ensure our centers remain best-in-class from a

hygiene standard.

Ongoing support:

• Marketing and consumer insights: our centralized marketing strategy, funded by contributions from our franchisees based on a percentage of

gross sales, net of retail product sales, as defined in the franchise agreement, allows us to leverage our scale in media buying and utilize our

proprietary guest insights to maximize brand awareness and consideration.

• Uniform Point-of-Sales System: we leverage a consistent Point-of-Sales system across our entire network which is easy to adopt and results in a

streamlined approach to ongoing technical support for our franchisees.

• Procurement and supply chain: our operating leverage and our scale allows us to procure the highest quality products at lower prices than smaller

independent waxing-focused operators benefiting our franchisees.

• Performance management: our team of Franchise Business Consultants works closely with our franchisees across regional territories with

ongoing managerial support including: monthly business reviews, per-center brand health and voice-of-customer measurement and additional

one-on-one support as needed.

These support services allow our franchisees to focus on the day-to-day operations of their centers and to provide high-quality services that our guests have

come to associate with our brand. We also participate in a Brand Advisory council, through which we collect continuous feedback from our franchisees to

enhance our offering, business model and support services, and to ensure that our franchisees have an open channel of communication with us.

7

Franchise Unit-Level Economics

A European Wax Center location typically reaches maturity in year five of operations, at which point a center generates on average $1.0 million in revenue

and annual cash-on-cash returns in excess of 60%. A typical franchisee initially invests approximately $356,000 when opening a new center (excluding real

estate purchase or lease costs, pre-opening expenses and initial working capital investment), with ongoing fees that are determined by the service sales of

each center. These ongoing fees include royalty and marketing fund contributions, which are 6% and 3% of service sales, respectively. Our centers follow a

highly predictable maturation curve once open that is consistent across cohorts and geographies, with an average unit volume of $0.7 million and double-

digit EBITDA margins already in year two of operations.

Competition

The OOH waxing industry is highly fragmented with more than 10,000 independent waxing operators and almost 100,000 beauty salons that provide

waxing as a small part of their broader service offerings. Within OOH waxing, we compete with independent waxing operators, beauty salons, beauty

parlors, health clubs, spas, beauty supply stores and other independently owned companies. We believe that we compete favorably on the basis of a number

of factors, including the quality of our services, the trustworthiness of our brand, our best-in-class hygiene standards, convenience, accessibility, guest

experience and the depth of our experience as experts within OOH waxing.

We also compete with other types of hair removal alternatives, including laser hair removal, sugaring, threading, as well as in-home solutions, such as

shaving, chemical-based creams, epilators, at-home laser hair removal and at-home waxing. OOH laser hair removal is a semi-permanent solution that is

significantly more expensive than OOH waxing and presents potential safety risks. Sugaring and threading are both less effective options than OOH

waxing and have not been widely adopted among consumers. At-home shaving lasts for a significantly shorter time than waxing, and other at-home

solutions are frequently viewed as less effective, messier, more painful and more time-consuming than OOH services administered by highly-trained

specialists.

We also compete with other franchisors on the basis of the expected return on investment for franchisees and the value proposition that we offer them. We

compete to sell franchises to potential franchisees who may choose to purchase franchises from other service providers in other markets.

Suppliers and Distributors

To preserve brand integrity and consistency, we require our franchisees to purchase products related to the operation of their franchised centers, including

our wax and branded skin care products, either from us, our affiliates or approved suppliers. We maintain strong, longstanding relationships with our

suppliers to ensure market competitiveness and reliability in our supply chain. We leverage our sizeable spend to obtain favorable terms from our suppliers

and to provide competitive prices to our franchisees, thus improving profitability and providing a considerable advantage over competitors that lack our

scale. We believe that as our business continues to grow, our scale will continue to drive increased procurement benefits across our business.

Our products are manufactured by market leaders, and we partner with two overseas suppliers with multiple facilities in Spain and France to source our

wax and one supplier to source our branded retail products. We currently have a long-term contract with only one of our wax suppliers. Our manufacturing

partners arrange for delivery of products either to one of the three third-party distribution centers that supply our centers or directly to our franchised and

corporate-owned centers.

We typically keep three to six months of wax inventory at three third party distribution centers to sustain system-wide supply and protect against shortfalls

that could arise from unforeseen market unavailability. These three distribution centers are located in Pennsylvania, Tennessee, and Nevada to provide

optimal distribution capability for us to meet the demands from centers throughout the United States. We believe that the existing supply chain we have in

place is sufficient to support our future growth.

Information & Technology Systems

We utilize our information technology infrastructure to facilitate data-driven management decisions. Across our franchise system, we use a fully integrated

platform that helps franchisees with reporting, marketing, operations, guest service and center management. Our technology platform gives management

access to key reporting metrics across our network, providing comprehensive insight into system health. In addition, we recently rolled out a new point of

sale system that uses cloud-based technology to process and store information.

Governmental Regulation

Our operations are subject to numerous federal, state, local and municipal laws and regulations in the United States in areas such as consumer protection,

occupational licensing, environmental protection, data privacy, labor and employment, tax, permitting, and other laws and regulations. In certain

jurisdictions, we must obtain licenses or permits in order to comply with standards governing employee selection, training and business conduct.

We, as a franchisor, are subject to various federal and state laws, and the Federal Trade Commission (the “FTC”) regulates our franchising activities in the

United States. The FTC requires that franchisors make extensive disclosure to prospective franchisees

8

before the execution of a franchise agreement. Fourteen states require registration and, together with at least one other state, require specific disclosure in

connection with franchise offers and sales, and at least twenty states and U.S. territories have “franchise relationship laws” that limit the ability of

franchisors to terminate franchise agreements or withhold consent to the renewal or transfer of these agreements.

We are not aware of any federal, state, local, municipal or other laws or regulations that are likely to materially alter or impact our revenues, cash flow or

competitive positions, or result in any material capital expenditures. However, we cannot predict the effect on our operations, particularly on our

relationship with franchisees, of any pending or future legislation or regulations or the future interpretation of any existing laws, including any newly

enacted laws, that may impact us or our franchisees.

Human Capital

As of December 25, 2021, we employed approximately 111 full-time employees, including approximately five full-time employees at corporate-owned

centers. We also employ approximately 76 part-time associates. None of these employees are covered by a collective bargaining agreement. We consider

our relations with our employees to be good. Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing

and integrating our existing and prospective employees. The principal purposes of our incentive plans are to attract, retain and motivate selected employees,

executive officers and directors through the granting of stock-based compensation awards and cash-based performance bonus awards. We strive for

exceptional performance and results, which is why meritocracy is one of our core values. We provide employees the opportunity to grow and to be

rewarded based on results.

To ensure the safety of our and our franchisees’ employees during the COVID-19 pandemic, we refined our in-center atmosphere to allow for contactless

check-in at all centers and elevated our hygiene standards at all centers. We sanitize all wax suites with disinfectant wipes after each guest’s visit and

require our franchisees to carry an inventory of gloves, face masks and other personal protective equipment.

Our franchises are independently owned and operated businesses. As such, employees of our franchisees are not employees of European Wax Center, Inc.

or EWC Ventures.

Intellectual Property

Our trademarks are important to our marketing efforts and conduct of business. We own or have the rights to use certain trademarks, service marks and

trade names that are registered or for which registration applications are pending with the U.S. Patent and Trademark Office or exist under common law in

the United States. Trademarks that are important in identifying and distinguishing our products and services include, but are not limited to EUROPEAN

WAX CENTER

®

, EWC

®

, STRUT 365

®

, WAX PASS

®

and COMFORT WAX

®

. We also own domain names, including our primary domain

“www.waxcenter.com.”

Seasonality

Seasonal changes may moderately impact the demand for our waxing services. For example, our guests may come to our centers more frequently in the

summer months and during the November to December holiday season.

Available Information

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith, we file reports, proxy

and information statements and other information with the SEC. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K, proxy and information statements and other information and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d)

of the Securities Exchange Act of 1934 are available through the investor relations section of our website. Our Internet address is www.waxcenter.com.

Reports are available on our website free of charge as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. In

addition, our officers and directors file with the SEC initial statements of beneficial ownership and statements of change in beneficial ownership of our

securities, which are also available on our website at the same location. We are not including this or any other information on our website as a part of, nor

incorporating it by reference into, this Form 10-K or any of our other SEC filings.

In addition to our website, the SEC maintains an Internet site that contains our reports, proxy and information statements, and other information that we

electronically file with, or furnish to, the SEC at www.sec.gov.

Item 1A. Risk Factors.

Our operations and financial results are subject to various risks and uncertainties, including those described below. You should consider and carefully read

all the risks and uncertainties described below, together with all the other information contained in this Annual Report on Form 10-K, including the section

titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related

notes, before making an investment decision. The risks described below are not the only ones we face. The occurrence of any of the following risks or

additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our

business, financial condition, or results of operations. In such case, the trading price of our Class A common stock could decline.

9

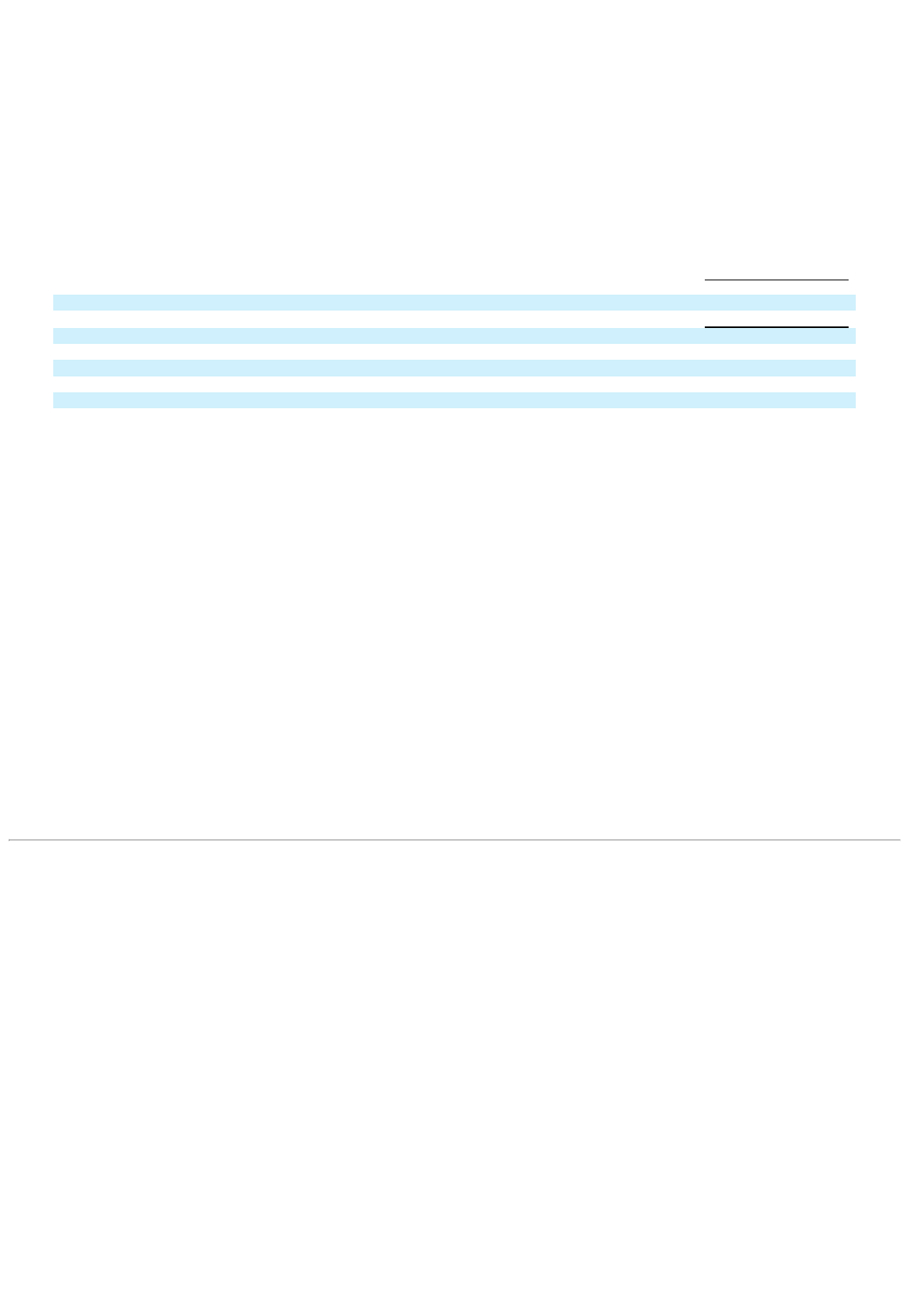

SUMMARY RISK FACTORS

The following is a summary of some of the significant risks and uncertainties that could materially adversely affect our business, financial condition, results

of operations, cash flows and the market price of our common stock. You should read this summary together with the more detailed description of these and

other risk factors contained below.

Risks Relating to Our Business

• Our business is affected by the financial results of our franchisees.

• If our franchisees are unable to successfully enter new markets, select appropriate sites for new centers or open new centers, our growth

strategy may not succeed.

• Our success depends on the effectiveness of our marketing and advertising programs and the active participation of franchisees in such

marketing and promotional activities.

• Franchisees could take actions that could harm our brand, including failing to comply with their franchise agreements and policies, and

adversely affect our business.

• Our and our franchisees’ centers may be unable to attract and retain guests, which would materially and adversely affect our business, results

of operations and financial condition.

• Increased use of social media may adversely impact our reputation and adversely affect sales and operating results.

• The high level of competition we face could materially and adversely affect our business.

• Our ability to improve our financial performance depends on our ability to anticipate and respond to market trends and changes in consumer

preferences.

• Our planned growth could place strains on our management, employees, information systems and internal controls, which may adversely

impact our business.

• Our financial performance could be materially adversely affected if we fail to retain, or effectively respond to a loss of, key executives.

• If our technology-based guest services systems do not function effectively, our operating results could be materially adversely affected.

• We are heavily dependent on computer systems and information technology and any material failure, interruption or security breach of our

computer systems or technology could impair our ability to efficiently operate our business.

• The occurrence of cyber-incidents, or a deficiency in cybersecurity, could negatively impact our business by causing a disruption to our

operations, a compromise or corruption of confidential information, and/or damage to our employee and business relationships, all of which

could lead to loss and harm our business.

• If we fail to properly maintain the confidentiality and integrity of our data, including guest credit card, debit card and, bank account

information and other personally identifiable information, our reputation and business could be materially and adversely affected.

• We and our franchisees rely heavily on information systems, and any material failure, interruption or weakness may prevent us from

effectively operating our business and damage our reputation.

• We are subject to a number of risks related to ACH, credit card, debit card, and digital payment options it accepts.

• Changing regulations relating to privacy, information security and data protection could increase our costs, affect or limit how we collect and

use personal information and harm our brands in a manner that adversely affects our business.

• Our level of indebtedness could have a material adverse effect on our ability to generate sufficient cash to fulfill our obligations under such

indebtedness, to react to changes in our business and to incur additional indebtedness to fund future needs.

• Our 2026 Credit Agreement contains financial covenants and other restrictions on our actions that may limit our operational flexibility or

otherwise adversely affect our business, financial condition and results of operations.

Risks Relating to the Franchisees

• Nearly all of our centers are owned and operated by franchisees and, as a result, we are highly dependent upon our franchisees.

• It is important for us and our franchisees to attract, train, and retain talented wax specialists and managers.

10

• Franchisees are operating entities exposed to risk.

• Changes in labor costs, other operating costs, such as commodity costs, interest rates and inflation could adversely affect our results of

operations.

• We may not be able to retain franchisees or maintain the quality of existing franchisees.

• Our center development plans under development agreements may not be implemented effectively by franchisees.

Risks Relating to our Suppliers and Distributors

• We depend on a limited number of key suppliers, including international suppliers, to deliver high-quality products at prices similar to

historical levels.

• Changes in supply costs could adversely affect our results of operations.

• Decreases in our product sourcing revenue could adversely affect our results of operations.

• Supply chain shortages and interruptions could adversely affect our business.

• Operational failure at one of the distribution centers that supply our centers would impact our ability to distribute products.

Risks Relating to Intellectual Property

• Our success and the success of our franchisees depends on the adequate protection of our intellectual property and litigation to enforce our

intellectual property rights may be costly.

• If we are unable to adequately protect our intellectual property, the strength of our brand may be weakened, and our business could be

harmed significantly.

• If franchisees and other licensees do not observe the required quality and trademark usage standards, our brands may suffer reputational

damage, which could in turn adversely affect our business.

Risks Relating to Our Organization and Structure

• We are a holding company and our principal asset is our 58.0% equity interest in EWC Ventures, and we are accordingly dependent upon

distributions from EWC Ventures to pay dividends, if any, and taxes, make payments under the tax receivable agreement and cover other

expenses, including our corporate and other overhead expenses.

• Our organizational structure, including the TRA, confers certain benefits upon the EWC Ventures Pre-IPO Members that do not benefit

holders of our Class A common stock (other than the EWC Ventures Pre-IPO Members) to the same extent that it benefits the EWC Ventures

Pre-IPO Members.

• The General Atlantic Equityholders, whose interests in our business may be different than yours, hold a significant percentage of the

combined voting power of our common stock and certain statutory provisions afforded to stockholders are not applicable to us.

Risks Relating to our Class A Common Stock

• Our stock price may be volatile, and the value of our Class A common stock may decline.

• We cannot predict the effect our dual-class structure may have on the market price of our Class A common stock.

• Substantial future sales of shares of our Class A common stock in the public market could cause our stock price to fall.

• Failure to establish and maintain effective internal control over financial reporting could have a material adverse effect on our business,

financial condition, results of operations and stock price.

• Certain of our key operating metrics are subject to inherent challenges in measurement, and any real or perceived inaccuracies in our metrics

or the underlying data may cause a loss of investor confidence in such metrics and the market price of our Class A common stock may

decline.

• We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth

companies will make our Class A common stock less attractive to investors.

11

Risks Relating to Our Business

Our business is affected by the financial results of our franchisees.

A substantial portion of our revenue comes from royalties generated by, and sales of wax and retail products to, our franchised centers. Accordingly, our

business is impacted by the operational and financial success of our franchisees, including the franchisees’ implementation of our strategic plans and their

ability to secure adequate financing. The employees of franchisees are not our employees. We provide training and support to franchisees, but the quality of

franchised center operations may be diminished by a number of factors beyond our control. Consequently, franchisees may not successfully operate centers

in a manner consistent with our standards and requirements or may not hire and train qualified managers and other center personnel. If they do not, our

image and reputation may suffer, and revenues could decline.

Additionally, if our franchisees are impacted by weak economic conditions and are unable to secure adequate sources of financing, their financial health

may worsen, our revenues may decline, and we may need to offer extended payment terms or make other concessions. Additionally, refusal on the part of

franchisees to renew their franchise agreements may result in decreased payments from franchisees. Furthermore, if our franchisees are not able to obtain

the financing necessary to complete planned remodel and construction projects, they may be forced to postpone or cancel such projects.

Furthermore, a bankruptcy of any multi-unit franchisee could negatively impact our ability to collect payments due under such franchisee’s agreements. In

a franchisee bankruptcy, the bankruptcy trustee may reject its franchise agreements under the applicable bankruptcy code, in which case there would be no

further royalty payments from such franchisee. The amount of the proceeds, if any, that may ultimately be recovered in a bankruptcy proceeding of such

franchisee may not be sufficient to satisfy a damage claim resulting from such rejection. See “—Nearly all of our centers are owned and operated by

franchisees and, as a result, we are highly dependent upon our franchisees.”

If our franchisees are unable to successfully enter new markets, select appropriate sites for new centers or open new centers, our growth strategy may

not succeed.

Our growth strategy includes entering into franchise agreements and development agreements with franchisees who will open additional centers in markets

where there are either an insufficient number or relatively few or no existing centers. We rely heavily on these franchisees and developers to grow our

franchise systems, and there can be no assurance that we will be able to successfully expand or acquire critical market presence for our brands in new

geographical markets in the United States. Consumer characteristics and competition in new markets may differ substantially from those in the markets

where we currently operate. Additionally, we may be unable to identify qualified franchisees, develop brand recognition, successfully market our products

or attract new guests in such markets and our franchisees may be unable to identify appropriate locations in such markets. See “—Our center development

plans under development agreements may not be implemented effectively by franchisees” herein.

Our franchisees face many other challenges in opening additional centers, including:

• availability of financing on acceptable terms;

• selection and availability of and competition for suitable center locations;

• negotiation of acceptable lease terms;

• securing required applicable governmental permits and approvals;

• impact of natural disasters and other acts of nature and terrorist acts or political instability;

• availability of franchise territories not prohibited by the territorial exclusivity provisions of existing franchisees;

• employment, training and retention of qualified personnel;

• exposure to liabilities arising out of sellers’ prior operations of acquired centers;

• incurrence or assumption of debt to finance acquisitions or improvements and/or the assumption of long-term, non-cancelable leases; and

• general economic and business conditions.

Should our franchisees not succeed in opening additional centers or improving existing centers, there may be adverse impacts to our growth strategy and to

our ability to generate additional profits, which in turn could materially and adversely affect our business and results of operations.

A component of our business strategy includes the construction of additional centers and the renovation and build-out of existing centers by our

franchisees, and a significant portion of the growth in our franchisees’ sales and profit margins will depend on growth in comparable sales for our centers.

Our franchisees face competition from other operators, retail chains, companies, and developers for desirable center locations, which may adversely affect

the cost, implementation, and timing of our franchisees’ expansion plans. If

12

our franchisees experience delays in the construction or remodeling processes, they may be unable to complete such activities at the planned cost, which

could adversely affect our franchisees’ business and results of operations. Additionally, our franchisees cannot guarantee that such remodeling will increase

the revenues generated by these centers or that any such increases will be sustainable. Likewise, our franchisees cannot be sure that the sites they select for

additional centers will result in centers that meet sales expectations. Our franchisees’ failure to add a significant number of additional centers or grow

comparable sales for our centers could materially and adversely affect our business and results of operations.

In particular, because nearly all of the development of additional centers is likely to be funded by franchisee investment, our growth strategy is dependent

on our existing and prospective franchisees’ ability to access funds to finance such development. We do not generally provide our franchisees with direct

financing and therefore their ability to access borrowed funds generally depends on their independent relationships with various financial institutions. In

addition, labor and material costs expended will vary by geographical location and are subject to general price increases. The timing of these improvements

can affect the performance of a center, particularly if the improvements require the relevant center to be closed. If our existing and prospective franchisees

are not able to obtain financing at commercially reasonable rates, or at all, they may be unwilling or unable to invest in the development of additional

centers. In addition, our growth strategy may take longer to implement and may not be as successful as expected. Both of these factors could reduce our

competitiveness and future sales and profit margins, which in turn could materially and adversely affect our business and results of operations.

Furthermore, the ability of our franchisees to enter new markets and grow our business may not be indicative of future growth. Our various business

strategies and initiatives, including our growth of franchisees, are subject to business, economic and competitive uncertainties and contingencies, many of

which are beyond our control. The historic conversion rate of signed commitments to new franchised centers may not be indicative of the conversion rates

we will experience in the future.

Our success depends on the effectiveness of our marketing and advertising programs and the active participation of franchisees in such marketing and

promotional activities.

Brand marketing and advertising significantly affect sales at our centers. Our marketing and advertising programs may not be successful, which may

prevent us from attracting new guests and retaining existing guests. We rely heavily on the active participation of our franchisees for the implementation of

marketing initiatives to be successful. Our inability to mandate franchisees to participate in marketing and promotional activities or our franchisees’

inability to successfully implement these initiatives could adversely affect our business results. Also, because many of the franchisees are contractually

obligated to pay advertising fees based on a percentage of their service revenues, our advertising budget depends on sales volumes at these centers. While

we and certain of our franchisees have sometimes voluntarily provided additional funds for advertising in the past, we are not legally obligated to make

such voluntary contributions or loan money to pay for advertising. If sales decline, we will have fewer funds available for marketing and advertising, which

could materially and adversely affect our revenues, business and results of operations.

As part of our marketing efforts, we rely on traditional, social and digital advertising, as well as search engine marketing, web advertisements, social media

platforms and other digital marketing to attract and retain guests. These efforts may not be successful, resulting in expenses incurred without the benefit of

higher revenues or increased employee or guest engagement. A failure to sufficiently innovate, develop guest relationship initiatives, or maintain adequate

and effective advertising could inhibit our ability to maintain our brand relevance and drive increased sales. Guests are increasingly using internet sites and

social media to inform their purchasing decisions and to compare prices, product assortment, and feedback from other guests about quality, responsiveness

and guest service before purchasing our services and products. If we are unable to continue to develop successful marketing and advertising strategies,

especially for online and social media platforms, or if our competitors develop more effective strategies, we could lose guests and sales could decline. In

addition, a variety of risks are associated with the use of social media and digital marketing, including the improper disclosure of proprietary information,

negative comments about or negative incidents regarding us, exposure of personally identifiable information, fraud or out-of-date information. The

inappropriate use of social media and digital marketing vehicles by us, our franchisees, our guests, employees or others could increase our costs, lead to

litigation or result in negative publicity that could damage our reputation. Many social media platforms immediately publish the content, videos and/or

photographs created or uploaded by their subscribers and participants, often without filters or checks on accuracy of the content posted. Information posted

on such platforms at any time may be adverse to our interests and/or may be inaccurate. The dissemination of negative information related to our brands

could harm our business, prospects, financial condition, and results of operations, regardless of the information’s accuracy. The harm may be immediate

without affording us an opportunity for redress or correction. The occurrence of any such developments could have an adverse effect on our business

results and on our profits.

Franchisees could take actions that could harm our brand, including failing to comply with their franchise agreements and policies, and adversely

affect our business.

Franchisees are contractually obligated to operate their centers for the contractual terms and in accordance with the standards set forth in the franchise

agreements, including specified service and product quality standards and other requirements, in order to protect our brand and to optimize its performance.

However, franchisees are independent third parties that we do not control, and the franchisees own, operate and oversee the daily operations of their

centers. As a result, the ultimate success and quality of any franchised center rests with the franchisee. If

13

franchisees provide substandard services, receive through the supply chain defective products or do not successfully operate centers for the contractual

terms and in a manner consistent with required standards, franchise royalty payments to us will be adversely affected and our image and reputation could

be harmed, which in turn could hurt our revenues, results of operations, business and financial condition.

In addition, we may be unable to successfully implement our business model, company policies, or brand development strategies that we believe are

necessary for further growth if franchisees do not participate in that implementation. Our revenues, results of operations, business and financial condition

could be adversely affected if a significant number of franchisees do not participate in brand strategies.

Our and our franchisees’ centers may be unable to attract and retain guests, which would materially and adversely affect our business, results of

operations and financial condition.

Our target market is people seeking regular out-of-home waxing services who consider waxing services a meaningful component of their personal-care and

beauty regimens. Our and our franchisees’ marketing efforts may not be successful in developing repeat guests and guest levels may materially decline

over time. In addition, we experience attrition and must continually engage existing guests and attract new guests in order to maintain profitability. Some of

the factors that could lead to a decline in guest retention include changing desires and behaviors of consumers or their perception of our brand, changes in

discretionary spending trends and general economic conditions, market maturity or saturation, a decline in our ability to deliver quality service at a

competitive price, direct and indirect competition in our industry, and a decline in the public’s interest in waxing services or personal-care, among other

factors.

Furthermore, the success of our business depends in part on our and our franchisees’ ability to grow the number of our Wax Pass holders. Our Wax Pass

program drives guest loyalty and provides valuable data and insights on our core guests, without which it may be difficult for us to adapt to changing guest

preferences or predict market trends. If we and our franchisees are not successful in optimizing prices or in adding new Wax Pass holders in new and

existing centers, growth in program fees may suffer. Any decrease in our guest attraction or retention levels or average program fees, or increase in

program costs, may adversely impact our results of operations and financial condition.

Increased use of social media may adversely impact our reputation and adversely affect sales and operating results.

There has been a substantial increase in the use of social media platforms, including blogs, social media websites and other forms of digital

communications, and the influence of social media influencers in the personal-care and beauty products industry, that allow individuals access to a broad

audience of consumers and other persons, including to our guests. Events reported in the media, including social media, whether or not accurate or

involving European Wax Center, could create and/or amplify negative publicity for us or for the industry or market segments in which we operate. Social