Gaming Tax Law and Bank Secrecy Act Issues

SECTION I OVERVIEW

Federal Law and Regulations ..................................................................................................... 1

Indian Gaming Regulatory Act (IGRA)

Bank Secrecy Act (BSA), Title 31 of the Code of Federal Regulations

Section 352 of the USA PATRIOT Act of 2001

Federal Agency Partners ............................................................................................................ 2

Department of the Interior/Bureau of Indian Aairs

National Indian Gaming Commission (NIGC)

Financial Crimes Enforcement Network (FinCEN)

Oce of Foreign Assets Control (OFAC)

Determining Federal Tax Status of Indian Tribal Governments .................................................. 3

SECTION II RECORDKEEPING AND REPORTING

The Tribe’s Legal Responsibilities ..............................................................................................4

Bank Secrecy Act ....................................................................................................................... 4

Casino Denition

Recordkeeping Requirements

Anti-Money Laundering Compliance Programs (AML)

Suspicious Transactions

Structuring

Currency Transaction Reporting

Domestic and Foreign Vendors

SECTION III DISTRIBUTIONS FROM GAMING REVENUE

Per Capita Payments ................................................................................................................ 10

Guidelines for Per Capita Distribution Plans ............................................................................ 10

Gaming Distributions to Minors ................................................................................................ 10

Withholding Requirements of Distributions from Net Gaming Revenue .................................. 11

SECTION IV EMPLOYMENT TAX = PAYROLL TAX

Employment Tax .......................................................................................................................................12

Reporting Tip Income ............................................................................................................... 13

Tip Rate Determination/Education Program (TRD/EP) ............................................................14

Independent Contractor vs. Employee .................................................................................... 14

How to Make Federal Tax Payments ........................................................................................15

Employment Tax Penalties .......................................................................................................17

CONTENTS

Gaming Tax Law and Bank Secrecy Act Issues

SECTION V TAX ON WAGERING

Denitions .........................................................................................................................................

18

Wagering Excise Tax ................................................................................................................................ 18

Occupational Tax ......................................................................................................................................19

SECTION VI FILING REQUIREMENTS

Summary Filing Requirements for Tribal Gaming Operations ....................................................21

IRS Tax Forms to File for Gaming Activities .......................................................................22

Reporting and Withholding Gaming Winnings ...................................................................23

Verifying Residency .................................................................................................................. 28

FIRE .......................................................................................................................................... 29

Gaming Withholding and Reporting Threshold — Forms Needed ............................................30

Gaming Guidelines When to Withhold and Report Gaming Wins .................................................. 31

SECTION VII RESOURCES AND ASSISTANCE

Tax Information Materials .........................................................................................................32

Reporting Abuses/Schemes ..................................................................................................... 32

Customer Service Assistance .................................................................................................. 32

Gaming Tax Law and Bank Secrecy Act Issues

SECTION I OVERVIEW

All tribal governments conducting or sponsoring gaming activities must understand and comply with federal

requirements on income tax reporting, employment tax and excise tax. The requirements apply to gaming

activities whether they take place one time or throughout the year, and whether in their primary place of

operation or at remote sites.

The Indian Gaming Regulatory Act divides gaming activities into three classes:

• Class I consists of social games that have prizes of minimal value and traditional tribal games played in

connection with tribal ceremonies or celebrations.

• Class II primarily includes bingo (whether or not it is electronically enhanced), pull-tabs, lotto, punch

boards, tip jars, instant bingo, games similar to bingo and non-banking card games allowed by state law.

• Class III gaming includes all gaming that is not Class I or Class II gaming, primarily slot machines, casino

games, banking card games, dog racing, horse racing and lotteries.

This Internal Revenue Service (IRS) publication provides you with the tax law on gaming operations for these

activities. You’ll learn about recordkeeping, employment tax, tax on wagering, per capita distributions, forms

to le and more. You can download or order all IRS forms and publications mentioned in this publication at

www.irs.gov/forms-pubs.

Visit www.irs.gov/tribes for information for Indian Tribal Governments (ITG). For more information on gaming

tax law, you can contact your ITG specialist or the ITG group manager in your area (see Section VII). For

Customer Account Services, call 877-829-5500.

Federal Law and Regulations

Indian Gaming Regulatory Act (IGRA)

Since IGRA’s passage in 1988, tribes and states have successfully negotiated hundreds of Tribal-state gaming

compacts. Gaming provides signicant revenues for many Indian tribes.

Highlights of IGRA include:

• Provides a statutory basis for the regulation of Indian gaming to ensure that tribes are the primary

beneciaries

• Establishes federal standards for Indian gaming

• Shields gaming from organized crime and other corrupting inuences

• Ensures that the operators and players conduct gaming fairly and honestly

• Provides a statutory basis for the operation of gaming by Indian tribes to promote tribal economic

development, self-suciency and strong tribal governments

• Establishes the National Indian Gaming Commission (NIGC)

ú Independent federal regulatory authority for Indian gaming

ú Meets congressional concerns about Indian gaming and protects gaming as a means of generating

tribal revenue

1

1

Gaming Tax Law and Bank Secrecy Act Issues

Bank Secrecy Act (BSA), Title 31 of the Code of Federal Regulations

Casinos are cash intensive businesses that can oer a broad array of nancial services, such as:

• Deposit or credit accounts

• Facilities for transmitting and receiving funds transfers directly from other institutions

• Check cashing and currency exchange services

Since these services are similar to those provided by depository institutions and other nancial rms, casinos

are vulnerable to abuse by money launderers and tax evaders.

Highlights of the BSA include:

• Provides rules and regulations on reporting currency transactions greater than $10,000

• Provides rules and regulations on identication and recordkeeping requirements

• Creates an audit trail to help minimize illegal nancial transactions

• Covers casinos with gross annual gaming revenue exceeding $1,000,000

• Extends coverage to Indian casino operations in August 1996 and card clubs in August 1998

Section 352 of the USA PATRIOT Act of 2001

Section 352 of the USA PATRIOT Act of 2001 requires nancial institutions to establish anti-money laundering

programs. Casinos and card clubs comply with this requirement if they implement and maintain adequate

programs for compliance with the Bank Secrecy Act. See the United States Code, Title 31, Section 5318(h).

Federal Agency Partners

Department of the Interior/Bureau of Indian Affairs

Through its relationships with the Bureau of Indian Aairs and the National Indian Gaming Commission, the

Department of the Interior has approval responsibility for various reservation and tribal issues. This includes

overseeing revenue allocation plans associated with Indian gaming. The Bureau of Indian Aairs provides

services directly or through contracts, grants or compacts to the federally recognized tribes with a service

population of about 1.9 million American Indian and Alaska Natives.

National Indian Gaming Commission (NIGC)

The NIGC oversees Indian gaming. Its primary mission is to regulate gaming activities conducted by tribes on

Indian lands.

NIGC’s goals are:

• Promoting tribal economic development, self-suciency and strong tribal governments;

• Maintaining the integrity of the Indian gaming industry; and

• Ensuring that tribes are the primary beneciaries of their gaming activities.

Financial Crimes Enforcement Network (FinCEN)

The U.S. Department of the Treasury established the Financial Crimes Enforcement Network to provide a

government-wide multisource nancial intelligence and analysis network. The organization’s operation was

broadened in 1994 to include regulatory responsibilities for administering the Bank Secrecy Act.

2

Gaming Tax Law and Bank Secrecy Act Issues

Office of Foreign Assets Control (OFAC)

The Oce of Foreign Assets Control of the U.S. Department of the Treasury administers and enforces

economic and trade sanctions against targeted foreign countries and regimes, terrorists, international

narcotics trackers, those engaged in activities related to the proliferation of weapons of mass destruction,

and other threats to the national security, foreign policy or economy of the United States.

Determining Federal Tax Status of Indian Tribal Governments

While the NIGC is responsible for overseeing Indian gaming, the IRS is responsible for federal taxation issues

on gaming. The IRS is also responsible for any other federal tax issues involving Indian tribal governments.

Due to gaming compacts negotiated between the tribes and states, other types of regulations exist that

involve state oversight. Ultimately, the IRS interprets federal tax law on tribal entities and enterprises.

Even though Indian tribes are not subject to federal income tax, an individual tribal member not exempt from

income taxation must report gross income amounts distributed or constructively received.

1

In tribal gaming,

structure and ownership of a gaming operation has a signicant impact on the taxability of the income.

Example 1: A tribe may operate unincorporated businesses in or away from Indian country. The income

derived is not subject to federal income tax. If the tribe decides to incorporate its business, income may be

subjected to tax based on how the corporation is formed.

Example 2: A tribe may incorporate under the Indian Reorganization Act of 1934. This type of corporation

isn’t subject to income tax regardless of where the business is located. An approval article or certicate

signed by the Secretary of the Interior is evidence of incorporation under the Indian Reorganization Act.

Example 3: An Indian tribe located in Oklahoma is not eligible to incorporate under the Indian Reorganization

Act. Instead, an Oklahoma tribe may incorporate under the Oklahoma Indian Welfare Act. This type of

corporation is not subject to income tax regardless of where the business is located. An approval article or

certication signed by the Secretary of the Interior is evidence of incorporation under the Oklahoma Indian

Welfare Act.

Example 4: An Indian tribe may also form a corporation under state law. This type of corporation is ordinarily

subject to federal income tax on income earned on or after October 1, 1994, regardless of where the business

is located. Because the state charter creates an entity separate and distinct from the tribe, the federal income

tax applies to this new entity. A state issued certication of incorporation is evidence of incorporation under

state law.

2

3

1

Constructively received means you are generally taxed on income that is available to you, regardless of whether it is actually in your

possession.

Gaming Tax Law and Bank Secrecy Act Issues

SECTION II RECORDKEEPING AND REPORTING

The Tribe’s Legal Responsibilities

Tribal governments that conduct gaming operations deal with large numbers of individuals and currency.

Tribal gaming operations should actively oversee and control all the gaming activities to ensure that they

don’t divert funds to private individuals or for private purposes. The IGRA provides the framework to handle

necessary recordkeeping when a tribe is involved in Class II or Class III gaming and annual gross gaming

revenue is greater than $1 million. Note: Class I gaming on Indian land is not subject to IGRA provisions.

A wholly-owned tribal gaming operation must follow NIGC’s regulations outlined in the Minimum Internal

Control Standards (MICS) for Indian gaming. MICS apply to all tribal gaming operations regardless of whether

the tribe has hired a management company to run gaming operations or is directly overseeing gaming

operations. Most tribal gaming operations are formed through tribal-state gaming compacts. The compacts

also contain MICS. These standards apply if they are more stringent than the MICS.

The NIGC regulations cover the internal controls needed for all Class II and Class III gaming operations. A

tribe must also have an independent certied public accountant verify that the internal control systems in

place are compliant with either NIGC’s or the tribal-state compact internal control standards, whichever

standards are the most stringent. Failure to meet these standards may result in temporary closure and/or civil

nes.

Bank Secrecy Act

Casino Denition

BSA requirements apply to casinos and card clubs and designate them as nancial institutions if:

• State, local or tribal governments have licensed or authorized them to do business as casinos or card

clubs in the United States

• They have gross annual gaming revenues over $1,000,000

See the Code of Federal Regulations, Title 31, Sections 1010.100(t)(5)(i) and (t)(6)(i).

Recordkeeping Requirements

Whether the tribe has hired a management company to run their gaming operation or is running the operation

itself, the tribe must:

• Maintain all books and records used to determine gross and net income

• Determine information reporting responsibilities

Example 1: A tribal gaming operation sells pull-tabs during its bingo session. The box of pull-tabs contains

2,400 tickets that sell for $1 each. The gross receipts for that box of pull-tabs is $2,400, and the gaming

operation records must reect that amount.

Example 2: A player cashes in a $1 winning ticket for another ticket. $1 must be included in gaming operation

gross receipts and $1 is included is prizes awarded. The amounts cannot be “netted.”

Example 3: If the player does not have a Social Security number (SSN), determine if the player is a foreign

national subject to foreign withholding and Form 1042, Annual Withholding Tax Return for U.S. Source Income

of Foreign Persons, and Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, ling

requirements.

4

Gaming Tax Law and Bank Secrecy Act Issues

The NIGC regulations require the tribe to keep its books and records of Class II or Class III operations for at

least ve years. Additionally, the tribe must preserve its records to the later of:

• Four years after the employment tax return’s due date, or

• Four years from the date it paid the tax.

Tribal-state compacts may contain additional recordkeeping and reporting requirements for tribal gaming

operations. There are also special recordkeeping requirements for excise tax application. See Section V – Tax

on Wagering.

The BSA requires a casino or card club to maintain and retain the following operation records:

• Transmitted funds

ú More than $3,000

ú Must require identity verication

ú Must record and report to other nancial institutions in the payment chain regardless of the method of

payment

• Funds deposits, opened accounts or extended lines of credit

ú Must include the customer’s veried identication plus similar information for anyone else having a

nancial interest in the account regardless of residency

• Receipts showing transactions for or through each customer’s deposit or credit account

ú Must include the customer’s veried identication regardless of residency

• Bookkeeping entries containing a debit or credit to a deposit account or credit account

• Statements, ledger cards or other records of each deposit or credit account

ú Must show all transactions

• Credit extensions over $2,500

ú Must include the customer’s veried identication regardless of residency

• Requests, instructions or advice on any transactions involving people, accounts or places outside the

United States

ú Must include the customer’s veried identication regardless of residency

• Records prepared or received in the ordinary course of business that would be needed to reconstruct a

customer’s deposit or credit account

• Records required by other governmental agencies, for example, federal, state, local or tribal

• Records prepared or used to monitor customers’ gaming activity, for example, player rating records,

multiple transaction logs

• A list of transactions involving various types of instruments, cashed or disbursed, in face amounts of

$3,000 or more, regardless of whether currency is involved, including customer’s name and address

• A copy of the casino’s written compliance program

5

Gaming Tax Law and Bank Secrecy Act Issues

Additionally, card clubs must maintain and retain records of all customers’ currency transactions, including

all records in the form of currency transaction logs and multiple currency transaction logs. If a casino or card

club records, stores or retains any part of its records on any form of electronic media, they must ensure that

the data will be available and accessible for review in the same media. A casino or card club must retain

the originals (or on microlm) of all required records outlined by the Code of Federal Regulations, Title 31 -

Chapter X for ve years. These records must be led or stored to be accessible within a reasonable period of

time. For more information regarding record retention, see the Code of Federal Regulations, Title 31, Section

1010.410.

Anti-Money Laundering Compliance Programs (AML)

Section 352 of the USA PATRIOT Act of 2001 requires nancial institutions to establish anti-money laundering

programs. See the United States Code, Title 31, Section 5318(h) and the Code of Federal Regulations,

Title 31, Section 1021.210(a). A casino or card club complies with this requirement if the casino or card

club implements and maintains an adequate program for compliance with the Bank Secrecy Act. Section

1021.210(b) contains the specic compliance program requirements. Casinos and card clubs must develop

and implement a written program designed to assure and monitor compliance with the BSA.

The Bank Secrecy Act compliance program must include:

• A system of internal controls to assure ongoing compliance

• BSA requirements training for personnel

• Designated individuals to assure day-to-day compliance

• If available, automated data processing systems to be used in assuring compliance

• Internal or external independent testing for compliance with a scope and frequency commensurate with the

risks of money laundering and terrorist nancing, and the products and services provided

• Procedures for using all available information to determine and verify - when required - the person’s name,

address, Social Security or taxpayer identication number and other identifying information

• Procedures for using all available information to determine whether any suspicious transactions or patterns

of transactions should be reported

For more information on the Bank Secrecy Act’s anti-money laundering compliance program requirements,

see the Code of Federal Regulations, Section 1021.210.

The Oce of Foreign Assets Control (OFAC) is a separate oce within the U.S. Treasury Department.

OFAC also maintains requirements under their own compliance program for anti-money laundering. For

more information related to OFAC compliance programs, see the FAQ section of Questions from Financial

Institutions, specically Question #30. To avoid penalties from this separate program, casinos and card

clubs must additionally maintain a compliance program very similar to the Bank Secrecy Act’s anti-money

laundering program.

6

Gaming Tax Law and Bank Secrecy Act Issues

Suspicious Transactions

The BSA requires a casino or card club to le a suspicious activity report when it knows, suspects or has

reason to suspect that a transaction or pattern of transactions is suspicious and involves or aggregates

to $5,000 or more in funds or other assets. A transaction (conducted or attempted) is “suspicious” if the

transaction:

• Involves funds derived from illegal activity or is intended or conducted to hide or disguise funds or assets

derived from illegal activity, or to disguise the ownership, nature, source, location or control of the funds;

• Is designed to evade Bank Secrecy Act requirements, whether through structuring or other means; or

• Has no business or apparent lawful purpose, or is not the sort in which the customer would normally be

expected to engage, and the casino or card club knows of no reasonable explanation for the transaction

after examining the available facts, including the background and possible purpose of the transaction, or

involves the use of the casino or card club to facilitate criminal activity.

See the Code of Federal Regulations, Title 31, Section 1021.320.

Casinos and card clubs must use the Financial Crimes Enforcement Network BSA E-Filing System to report

suspicious activity. A casino or card club must le this form within 30 calendar days after initial detection of

the suspicious transaction. If the casino or card club does not identify the suspect on the date of detection,

it may delay ling a suspicious activity report for an additional 30 calendar days to do so. However, a casino

or card club must always report a suspicious transaction within 60 calendar days after the date of initial

detection. The following examples demonstrate how an activity may appear suspicious:

Example 1: A customer seeks to cash out chips, tokens or a ticket in an amount more than $10,000, but

when asked for identication for completing a Currency Transaction Report (CTR), they reduce the amount to

be cashed out to less than $10,000.

Example 2: A customer purchases large amounts of chips with currency at table games, engages in minimal

gaming and then redeems the chips for casino checks.

Example 3: A customer furnishes identication documents that are false or altered (for example, address

changed, photograph substituted).

Example 4: A customer requests the issuance of multiple casino checks that are made out to third parties or

checks without a specied payee.

Example 5: A casino suspects that customers are involved in credit card or check cashing fraud.

Note: When using the FinCEN BSA E-Filing System, a casino must use the legal name of the tribal casino.

A tribal casino’s legal name is found in the articles of incorporation or corporation charter. If the casino

is an unincorporated entity of the tribe then the legal name is the tribe itself. It’s important to make the

distinction between the casino’s legal name and trade name.

The Financial Crimes Enforcement Network’s Suspicious Activity Reporting Guidance for Casinos explains

how to prepare a complete and sucient “narrative” and provides examples.

7

Gaming Tax Law and Bank Secrecy Act Issues

Structuring

Federal law prohibits a nancial institution, including a casino or card club, to structure, attempt to structure

or assist in structuring transactions. Structuring pertains to conduct engaged in to evade a Bank Secrecy

Act reporting or recordkeeping requirement. It is unlawful under the Bank Secrecy Act and subjects a person

to civil and criminal penalties. See the United States Code, Title 31, Sections 5321, 5322 and 5324, and the

Code of Federal Regulations, Title 31, Section 1010.314.

Currency Transaction Reporting

A casino or card club must le a report for each cash-in or cash-out currency transaction it handles that

is more than $10,000. It must aggregate multiple currency transactions if the cash-in or cash-out amounts

during a single gaming day total more than $10,000. It would treat the cash-in or cash-out transactions as

a single transaction and as though conducted by or for the same person. It isn’t necessary to personally

observe the multiple transactions. The books, records, logs and computer les should contain the information

showing that the reportable currency transactions occurred. See the Code of Federal Regulations, Title 31,

Sections 1021.311 and 1021.313.

Example: While reviewing a customer’s account status on a computer in the gaming pit, a oor person

notices that a customer has already purchased $9,000 in chips with cash at another pit. Later, the customer

asks to purchase from the dealer an additional $5,000 in chips with cash that is approved by the oor person.

The casino is required to le a CTR because a casino employee had knowledge that the customer had cash-

in transactions over $10,000 in one gaming day.

When a winner’s aggregate amount exceeds $10,000, the casino or card club must report and le with

FinCEN’s BSA E-Filing System. To properly le the form, it must secure certain information from the customer

(including foreign nationals) before concluding the transaction unless the transaction is identied through

an “after the fact aggregation” process. During the “after the fact aggregation” process, the casino or card

club is still required to le a completed form. It should obtain all the required information if available through

internal records or systems examinations.

See the FinCEN CTR for instructions on how to complete the form and the Code of Federal Regulations, Title

31, Section 1010.312 for the requirement to identify persons involved in currency transactions.

Multiple currency transactions may reach the threshold reporting requirements for FinCEN CTR without

requiring Form W-2G, Certain Gambling Winnings, reporting. Casinos and card clubs must have procedures

in place to ensure accurate ling. An example would be multiple slot jackpots below $1,200 aggregating to

more than $10,000.

If a currency transaction exceeds $10,000 and is suspicious, a casino or card club must le a CTR

(reporting the currency transaction) and a Suspicious Activity Report (reporting the suspicious aspects of

the transaction). The casino or card club must transmit all completed FinCEN forms electronically within 15

calendar days from the date of the transaction through FinCEN’s BSA E-Filing System.

Currency transactions in other operational aspects of a casino complex may be subject to other reporting

requirements such as:

• Independent check cashers, money remitters, wire transfer companies, and so on, operating inside or

outside of a casino use a Currency Transaction Report.

• Casino nongaming activities such as hotels, retail outlets and other establishments use Form 8300, Report

of Cash Payments Over $10,000 Received in a Trade or Business. Cash for Form 8300 reporting purposes

includes coin, currency and cashier’s checks, bank drafts, traveler’s checks or money orders received

during a 12-month period.

8

Gaming Tax Law and Bank Secrecy Act Issues

Domestic and Foreign Vendors

A tribal gaming operation deals with vendors daily, and there are ling and withholding issues related to this

interaction. Domestic vendors generally provide Form W-9, Request for Taxpayer Identication Number and

Certication, to tribal gaming operations to avoid backup withholding when they are providing services.

A best practice for tribal gaming operations is to require the W-9 prior to payment of invoices for services

rendered. Tribal gaming operations that use foreign vendors must be aware of additional ling and withholding

requirements. The backup withholding for failure to provide a taxpayer identication number (TIN), discussed

more completely in Section VI, applies to domestic vendors.

It’s important to note that vendors from foreign countries are not subject to backup withholding rules but

instead, are subject to Internal Revenue Code (IRC) Section 1441 foreign withholding rules. These rules are

similar to the gaming withholding rules for nonresident aliens covered in Section VI of this publication. Foreign

vendors with domestic operations should have an EIN and domestic address, which would allow Form W-9

submission. Generally, Form W-8BEN, Certicate of Foreign Status of Benecial Owner for United States Tax

Withholding and Reporting (Individuals), is similarly used for foreign vendors.

There is no dollar threshold for withholding or reporting purposes related to Form 1042-S, Foreign Person’s

U.S. Source Income Subject to Withholding. A tribal gaming operation must withhold taxes and report any

payments paid to a nonresident vendor. The withholding rate on nonresident vendors is generally 30% unless

the foreign country has a treaty with the United States for a lower rate.

You can use Form W-8BEN for status determination of nonresident vendors. Use Section 1 for identication.

Nonresident vendors may claim a lower withholding rate under a treaty, if applicable, by preparing Section 2

of Form W-8BEN. However, a vendor still needs to provide a U.S. TIN to receive this treatment. If a vendor is

from a treaty country, but does not have a U.S. TIN, withhold 30% on Form 1042-S. Refer to Publication 901,

U.S. Tax Treaties, and Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

Use Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, for reporting

payments made to nonresident aliens and required withholding.

File Form 1042-T, Annual Summary and Transmittal of Forms 1042-S, with paper Forms 1042-S, Foreign

Person’s U.S. Source Income Subject to Withholding. Submit these forms to the IRS by March 15 of the

following year. You may voluntarily le electronically using the FIRE system.

If a tribal gaming operation les 250 or more Forms 1042-S during a year, the operation must submit the

forms electronically. Penalties may be assessed against a tribal gaming operator if the information shown on

the Form 1042-S is incomplete or incorrect.

Failure to Pay Withholding Tax

A tribal gaming operation is responsible for paying to the IRS the amount of foreign withholding due, whether

or not it collects the withholding from the recipient. The best time to collect foreign withholding is before it is

paid. Penalties are assessed for failure to deposit taxes withheld, failure to le a return on time and failure to

pay taxes on a return.

9

Gaming Tax Law and Bank Secrecy Act Issues

SECTION III DISTRIBUTIONS FROM GAMING REVENUE

Per Capita Payments

When a tribe distributes revenue to all its members or groups of members, it has provided a per capita

payment. Under IGRA, a federally recognized Indian tribe may use net revenues from Class II or Class III

gaming activities to make per capita payments to its tribal members only if four conditions are met:

1. It must prepare a plan to allocate revenues only for IGRA authorized uses to:

ú fund tribal government operations or programs,

ú provide for the general welfare of the Indian tribe and its members,

ú promote tribal economic development,

ú donate to charitable organizations, or

ú fund local government and agency operations.

2. The Secretary of the Interior must approve the revenue’s use, particularly when it’s for funding tribal

government operations or programs and for promoting tribal economic development.

3. The tribe must protect and preserve minors’ and other legally incompetent persons’ interests who are

entitled to receive any of the per capita payments. The tribe disperses these payments to their parents or

legal guardian for their health, education or welfare, under a plan approved by the Secretary and the tribe’s

governing body.

4. The per capita payments are subject to federal taxation and tribes notify members of this tax liability when

payments are made.

Guidelines for Per Capita Distribution Plans

The Department of Interior issues guidelines to govern the review and approval of per capita distribution

plans also known as revenue allocation plans (RAP). Tribal governments can make periodic or occasional

distributions by ordinance or resolution in the absence of a RAP. These guidelines provide procedures for

how tribes must submit tribal revenue allocation plans or ordinances for review and approval. These plans

and ordinances contain information about how tribes distribute net revenue distributions that comes from

a gaming activity. For approval, the allocation plan must provide enough detail indicating it complies with

the guidelines and IGRA. The tribe must also provide a percentage breakdown of how it intends to use and

allocate its net gaming revenues. The allocation plan must provide that the tribe plans to dedicate a signicant

portion of its net gaming revenues to one or more purposes as cited in the guidelines.

Gaming Distributions to Minors

The IGRA requires protections of the minors’ interests for gaming revenue distribution. To satisfy this

requirement, many tribes establish trusts for minors and legal incompetents. A tribe may serve as the grantor

and owner of the trust.

Revenue Procedure 2011-56 claries that deposits into a trust are taxable at the time the deposits are made.

If the funds are left in the trust account until the beneciary reaches the age of majority the principal and

interest are not reported as taxable income to the beneciary. The revenue procedure states that when an

IGRA trust earns money or receives a deposit, the beneciaries are not required to include those amounts

in their gross income. However, beneciaries who receive trust distributions would include the amounts as

taxable income when actually or constructively received.

2

10

2

When a beneciary has the unqualied right to the funds in a trust, the beneciary must include it as taxable income.

Gaming Tax Law and Bank Secrecy Act Issues

Example: Jane, a minor, is a member of a federally recognized tribe. The tribe creates a trust for her. She

cannot receive any distributions from the trust before she reaches age 18. Therefore, Jane does not include

the trust’s income as part of her gross income. She is not in constructive receipt of the funds placed in trust or

income earned by the trust, because she doesn’t have the unqualied right to receive immediate payment. As

a result, the accumulated per capita distributions and the related income are not taxable. However, if the tribe

gives the trustee (Jane’s legal guardian) approval to access the funds, those funds become taxable.

Withholding Requirements of Distributions from Net Gaming Revenue

Per capita distributions from gaming are subject to federal taxation under IRC Section 3402(r). Tribes must

notify its members of the tax liability when it makes the payments, reporting the per capita distributions on

Form 1099-MISC, Miscellaneous Income. When the tribal members receive their Forms 1099-MISC, they

report the income on the “Other Income” line of their Form 1040, U.S. Individual Income Tax Return, and

include a description as “Indian gaming prots.” These distributions are also subject to withholding. The

Social Security number of all payees should be secured prior to making payments. Otherwise, the tribe is

potentially liable for backup withholding provisions under IRC Section 3406. See Reporting and Withholding

Gaming Winnings of this publication and Form 945 ling requirements for more information. In the payments

section of Form 1040, the payee should report any withholding reected on Form 1099 as “federal income

tax withheld from Forms W-2 or 1099.” The tribe determines the withholding amount based on the total

payment to the tribal member for the year. Publication 15-A, Employer’s Supplemental Tax Guide, contains

the withholding tables (identied as “Tables for Withholding on Distributions of Indian Gaming Prots to Tribal

Members”). The tribe is potentially liable for the dierence between the amount required to be withheld under

the tables and the amount actually withheld.

The withholding tables are revised each year and generally published in January. There is a threshold for

requiring withholding which often changes annually. Once the threshold distribution amount is reached,

withholding is required between 10-24%.

Example: A tribe distributes $31,000 of per capita payments to tribal members during 2018. A regular monthly

per capita payment of $2,000 is issued during the months January through December. During December, an

additional per capita payment is made of $7,000, for a cumulative distribution of $9,000.

The computation for withholding on monthly per capita payments would be based on the $2,000 monthly

payment for January to November and for December, the aggregate payment amount of $9,000. Using the

tables for 2018 for monthly distributions, payments of $2,000 are subject to 10% withholding on the amount

over $1,000, or $100 (.10 x $1,000). The December payment would be $1,174.12 plus 24% of the amount

over $7,875 or $1,444.12 (1,174.12 + 270 (.24 x ($9,000 - $7,875))).

To avoid incorrect withholding, payments during a chosen distribution period should be aggregated as in the

example above.

11

Gaming Tax Law and Bank Secrecy Act Issues

SECTION IV EMPLOYMENT TAX = PAYROLL TAX

Employment Tax

“Wages” for purposes of FICA (Social Security and Medicare) and federal income tax withholding means all

payments received for “employment” with certain exceptions. Unless payments to employees are excepted

from the term “wages” or the services performed by the employee are excepted from the term “employment,”

the payments are subject to FICA and federal income tax withholding. Independent contractors and

employees are generally involved in gaming operations, and the gaming operation is responsible for ling

certain IRS tax forms. See the Independent Contractor vs. Employee section of this publication.

Tribal gaming operations (employers) must generally withhold income and FICA taxes. These are deposited to

the IRS on the employees’ behalf. Employers may also be subject to depositing unemployment tax on wages

paid to an employee (see exception below).

Employers are responsible for ling Form W-2, Wage and Tax Statement, and Form 941, Employer’s Quarterly

Federal Tax Return. To know how much income tax to withhold from employees’ wages, employers should

have a Form W-4, Employee’s Withholding Allowance Certicate, on le for each employee.

Exception – Federal employment tax also includes tax imposed under the Federal Unemployment Tax Act

(FUTA). Beginning January 1, 2000, Indian tribes and any wholly owned tribal business are not required to

le Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, if they participate in the State

Unemployment Tax Act (SUTA) system. The employer is no longer exempt from FUTA if the employer elects

not to participate in SUTA. The employer will become liable for FUTA taxes and will be required to le Form

940 with the IRS. Employers should be aware that nonparticipation in the state unemployment program may

make tribal employees ineligible for unemployment benets. For more information on FUTA tax for tribal

governments and their wholly owned tribal businesses, see Publication 4268, Employment Tax For Indian

Tribal Governments.

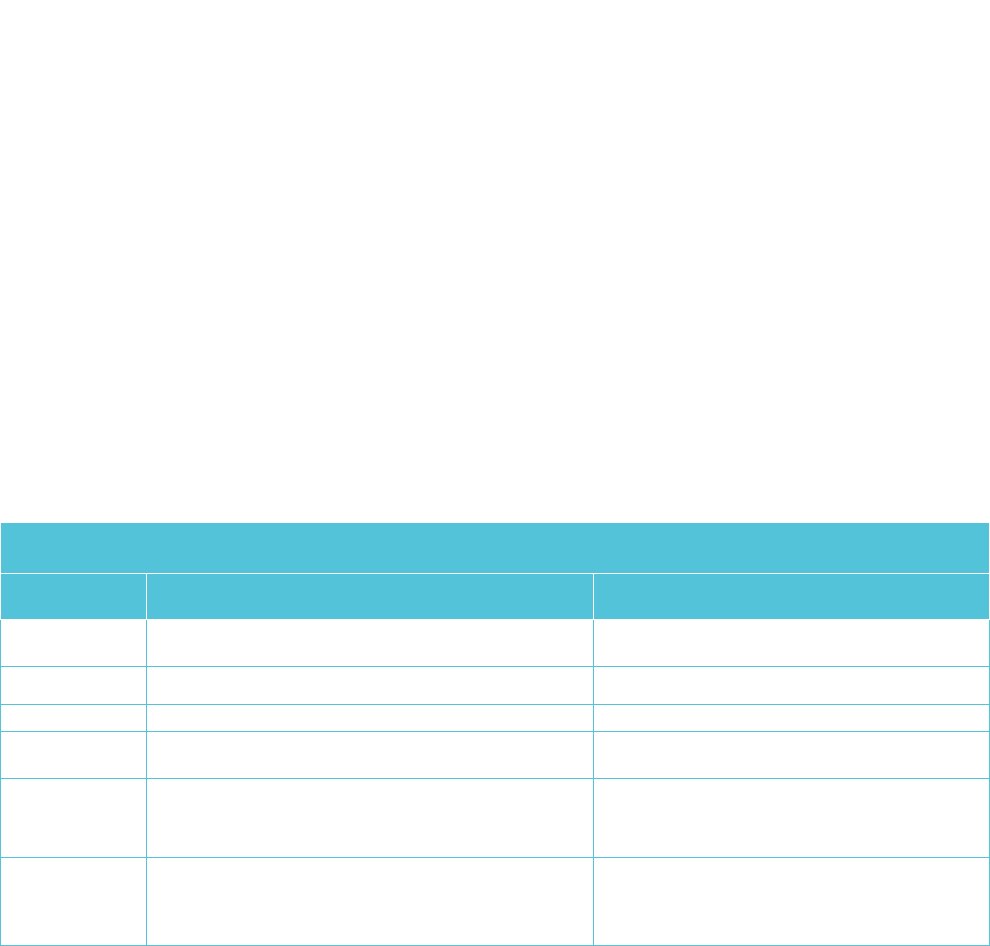

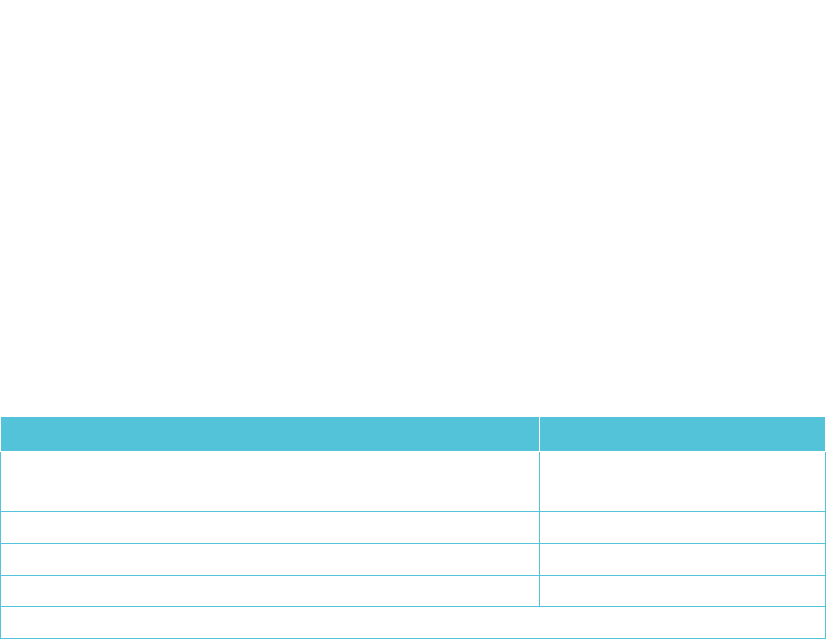

Forms to File for Employees

Form Employer’s responsibility When

W-4 Request signed W-4 from all employees

As soon as an employee starts work and should be

effective with the first wage payment

W-2 Furnish employee a copy of Form W-2 By January 31 of the year following year of payment

W-2 Furnish W-2 to the Social Security Administration By January 31 of the following year

W-3

Transmit paper Forms W-2 to the Social Security

Administration

By January 31 of the following year

941

Each employer is responsible for filing Form 941 - reporting

wages, federal income tax withholding, Social Security and

Medicare tax withholding each quarter

By the last day of the month following the end of the

calendar quarter

940

Each employer is responsible for filing Form 940 unless

participating in the state unemployment system and in full

compliance with its requirements.

By January 31 following the tax year

12

Gaming Tax Law and Bank Secrecy Act Issues

Reporting Tip Income

All tips received by an employee are taxable income subject to federal income tax. An employee must include

in gross income all tips received directly or indirectly such as:

• Cash tips

• Charge tips

• Tip-outs

• An employee’s share of a tip-splitting or tip-pooling arrangement

When an employee receives tips greater than $20 in a calendar month while working for any one employer,

FICA and federal income tax withholding applies to these funds. FICA and federal tax withholding does not

apply to tips of less than $20 in a calendar month. Once the tip amount in a calendar month reaches $20, the

employee must report their tips to the employer to be included as wages – not just the amount over $20. This

must be done in writing by the tenth day of the month following the month the employee receives the tips.

Example: Joe is a dealer at a tribal casino. He received $800 in tips in March. Joe must report his tips to his

employer by April 10, or more frequently if required by the employer. The tips are subject to FICA and federal

income tax withholding.

The IRS oce of Indian Tribal Governments oers workshops and presentations on tip income reporting. The

IRS has developed tools to assist employers and employees with tip compliance. Employees are required to

report tips to their employer monthly unless the tips were less than $20. Publication 1244, Employee’s Daily

Record of Tips and Report to Employer, a pocket-sized record available for order from the IRS, includes two

forms, 4070 and 4070A, for facilitating this reporting. The Form 4070A, Employee’s Daily Record of Tips, is

a monthly form tipped employees may use for keeping a daily record of tips received and tips paid out. The

Form 4070, Employee’s Report of Tips to Employer, is a monthly form tipped employees may use to provide

their employer a summary of the total amounts of tips received. For more information see Publication 531,

Reporting Tip Income, or contact the Indian Tribal Governments specialist in your area.

Many tribal gaming establishments have restaurants or bars that may run extended hours and allow

tipping. These establishments often meet the denition of a large food or beverage establishment resulting

in a ling requirement for Form 8027, Employer’s Annual Information Return of Tip Income and Allocated

Tips. Generally, a large food or beverage establishment is where there are more than 10 employees who

collectively work more than 80 hours in the typical business day. For more information consult the Form 8027

Instructions.

Other Resources

Publication 3144, Tips on Tips: A Guide to Tip Income Reporting for Employers in Businesses where Tip

Income is Customary

Publication 3148, Tips on Tips: A Guide to Tip Income Reporting for Employees Who Receive Tip Income

13

Gaming Tax Law and Bank Secrecy Act Issues

Tip Rate Determination/Education Program (TRD/EP)

Compliance with tip income reporting requirements can be one of the most complicated and dicult issues

for employers and employees. If noncompliance exists, both parties can be liable for payment of signicant

tax, penalties and interest. To reduce burden and improve tip reporting compliance by employers and

employees, the IRS has developed TRD/EP. In addition to participating in ITG educational and outreach

programs, gaming operations may enter into a Tip Rate Determination Agreement (TRDA) or a Gaming

Industry Tip Compliance Agreement (GITCA).

• TRDA – Under this arrangement, the employer determines tip rates for various occupations within the

establishment using historical tip data. The IRS reviews the data and validates the rates. At least 75% of

the tipped employees must agree to participate by signing a Tipped Employee Participation Agreement.

This arrangement is available for all tipped employees, gaming or nongaming, at the tribal gaming

operation.

• GITCA – Under this arrangement, a gaming industry employer and the IRS work together to reach an

agreement that objectively establishes minimum tip rates for tipped employees in specied occupational

categories, prescribes a threshold level of participation by the employer’s employees and reduces

compliance burdens for the employee and enforcement burdens for the IRS. See Revenue Procedure

2007-32 for more information on GITCAs.

Other Resources

Publication 4932, Gaming Industry Tip Compliance Agreement (GITCA)

Publication 4985, Gaming Industry Tip Compliance Agreement (GITCA) for Tipped Employees

Independent Contractor vs. Employee

For federal tax purposes, the distinction between independent contractor and employee is important. Workers

may be classied as employees or independent contractors. Worker classication aects your employees’

eligibility for Social Security and Medicare benets and determines your tax responsibilities. The courts

have considered many facts in deciding whether a worker is an independent contractor or an employee.

These relevant facts fall into three main categories: behavioral control, nancial control and relationship of

the parties. In each case, it is important to consider all the facts – no single fact provides the answer. (see

Publication 1779, Independent Contractor or Employee) This determination is necessary for the purposes of

ling the correct forms and paying the appropriate taxes (see Publication 4268, Employment Tax For Indian

Tribal Governments). For more information contact the Indian Tribal Governments specialist in your area.

A trade or business must le Form 1099-MISC, Miscellaneous Income, to report payments of $600 or more to

persons not treated as employees for services performed in a trade or business. The $600 threshold applies

to all payments made during the calendar year, not to any one payment. If you have a question regarding

Form 1099-MISC, refer to the 1099-MISC instructions or contact the Indian Tribal Governments specialist in

your area.

Form 1099-MISC requires a worker’s name, address and TIN. The worker should complete Form W-9,

Request for Taxpayer Identication Number and Certication. Employers use Form W-9 to verify a worker’s

TIN and to certify that the TIN is correct. Employers should secure the worker’s TIN before making the rst

payment; otherwise, payments would be subject to backup withholding. Report backup withholding on Form

945, Annual Return of Withheld Federal Income Tax. See Section VI for additional information related to ling

electronically and the TIN matching program.

14

Gaming Tax Law and Bank Secrecy Act Issues

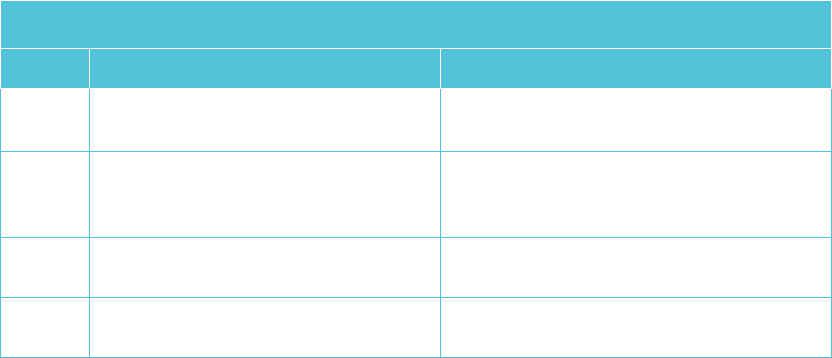

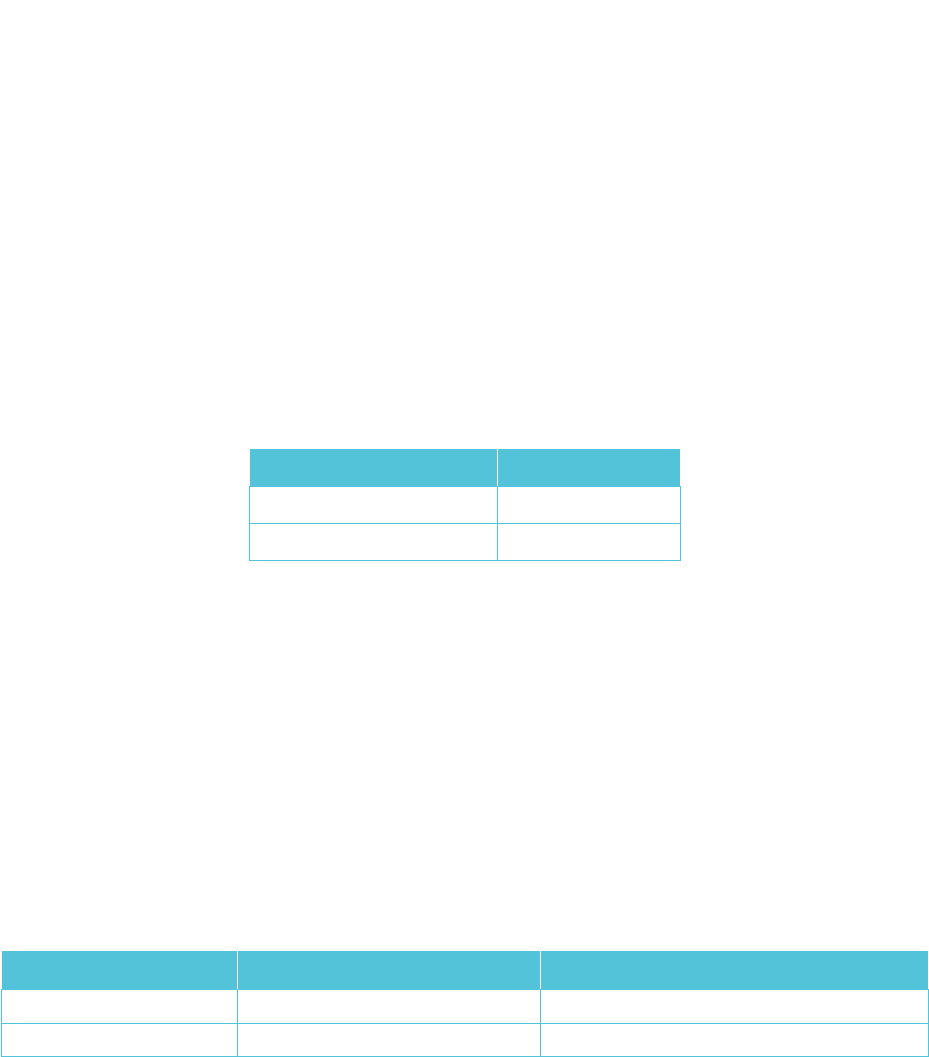

Forms to File for Independent Contractors

Form Payer’s responsibility When

W-9

Request and receive a properly completed and

signed W-9

W-9 should be received and kept on file prior to

making any payments

1099

Complete and furnish to each payee of $600 or

more (cumulative payments) per year

Must be sent to the IRS by January 31. Must furnish

to payee by last day of January 31 of the year

following the year of payment

1096 Transmittal form summarizing all 1099s issued

Must be filed by January 31 of the year following the

year of payment

945

Payer must file 945 for voluntary/backup

withholding

Must be filed by January 31 of the year following the

year of payment

Example 1: Employer pays John $1,000 per week to clean the bingo hall. John operates his own janitorial

service that performs work for numerous entities, has the right to hire and re his own help, and provides his

own tools and supplies. The employer does not have the right to direct and control John. Therefore, he is not

an employee. The employer should le Form 1099-MISC for John.

Example 2: Employer pays Jack $500 per week to clean the bingo hall. Jack works for only this employer,

does not have the right to hire and re assistants and the employer requires that he personally does the work.

The employer provides the supplies and tools for Jack. Based on the above facts, Jack is an employee. The

employer should withhold income tax and employment taxes and report the payments on Form W-2.

How to Make Federal Tax Payments

You must deposit through Electronic Federal Tax Payment System (EFTPS) amounts withheld such as:

• Employer and employee Social Security and Medicare taxes (Form 941)

• Income tax withheld (Form 941)

• Backup withholding (Form 945)

• Gambling withholding (Form 945)

• Foreign person withholding (Form 1042) (See Section VI)

Using EFTPS to deposit federal taxes provides substantial benets to taxpayers and the government. EFTPS

users can make tax payments 24 hours a day, seven days a week with a computer or by telephone. EFTPS

also signicantly reduces payment-related errors that could result in a penalty. The system helps taxpayers

schedule dates to make payments even when they are out of town or on vacation when a payment is due.

EFTPS business users can schedule payments up to 120 days in advance of the desired payment date. You

can nd more information including how to enroll online or by calling EFTPS Customer Service at 800-555-

4477 (TDD 800-733-4829).

When to Make Deposits

If you have a deposit requirement for Form 941, you may make a deposit:

• The same day you pay your employees, or

• Before the due date.

15

Gaming Tax Law and Bank Secrecy Act Issues

Form 941 Deposit Due Date

If you are a new employer and have never led a Form 941, you are a monthly schedule depositor for the rst

calendar year of your business unless you meet a special exception to the rule. Monthly schedule depositors

should deposit taxes from all their paydays in a month by the 15th of the next month, even if they pay wages

every week.

Employers with prior payrolls and taxes of $2,500 or more per quarter must determine if they make either

monthly schedule deposits or semiweekly schedule deposits. This determination is based on your Form 941

taxes during a four-quarter lookback period.

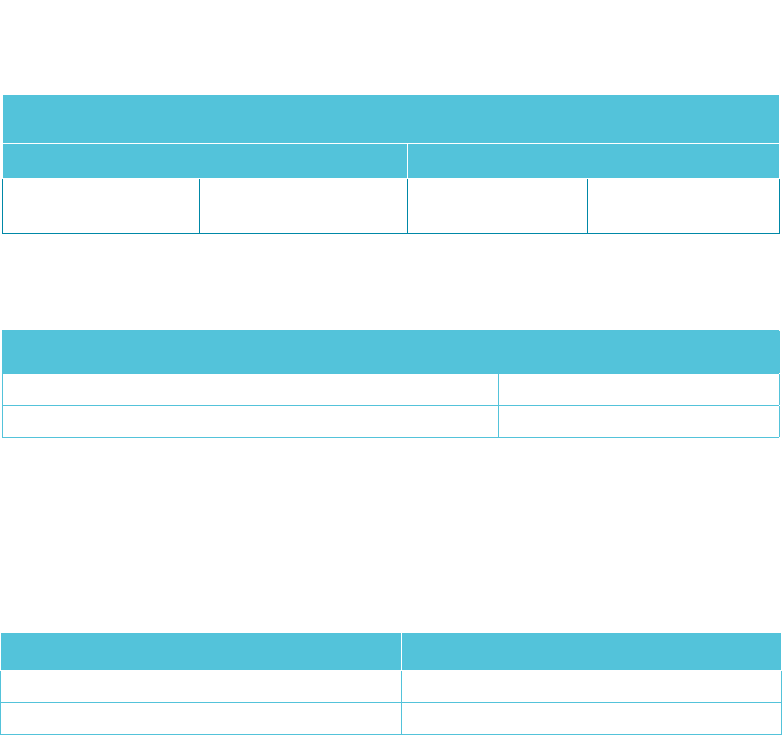

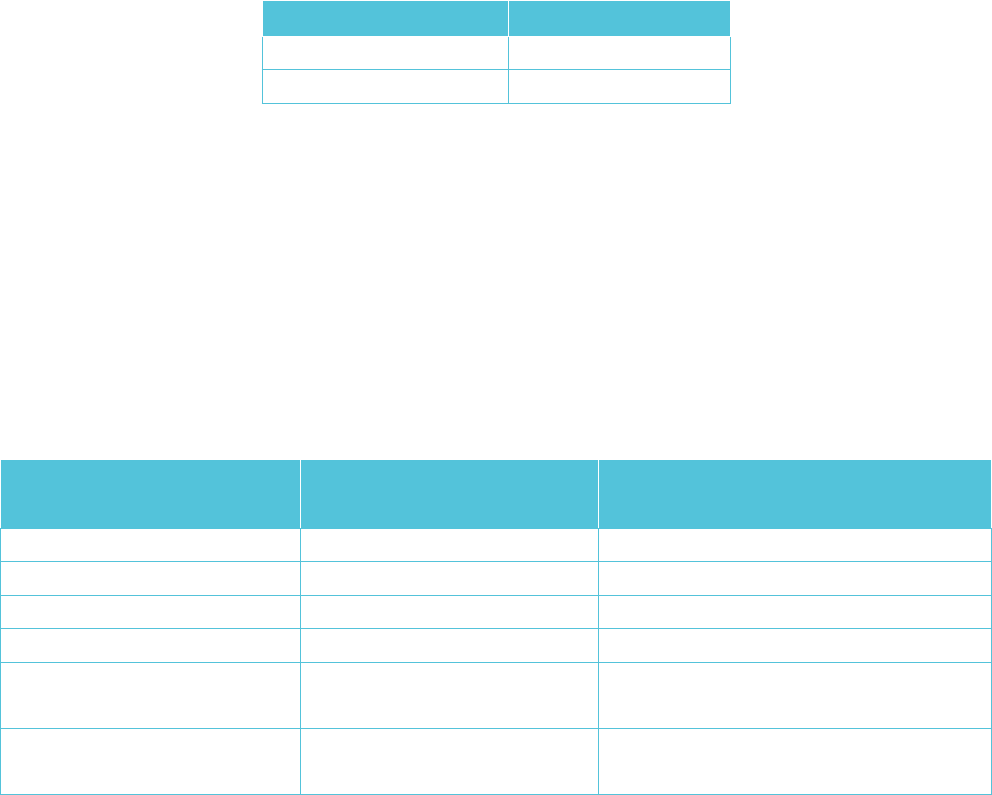

1. Identify your lookback period.

Your Lookback Period for Calendar Year 2020

2018 2019

July 1 to September 30

3rd Quarter

October 1 to December 31

4th Quarter

January 1 to March 31

1st Quarter

April 1 to June 30

2nd Quarter

2. Add the total taxes reported during the lookback period.

3. Determine your deposit schedule.

If the Total Taxes You Reported in the Lookback Period Were: Then You Are A:

$50,000 or less Monthly schedule depositor

More than $50,000 Semiweekly schedule depositor

Monthly Schedule Depositors

Deposit each month’s taxes by the 15th day of the following month (for example, taxes from paydays during

July are deposited by August 15).

Semiweekly Schedule Depositors

If the Payday Falls on A: Then Deposit Taxes by the Following:

Wednesday, Thursday or Friday Wednesday

Saturday, Sunday, Monday or Tuesday Friday

Exception: If you accumulate a tax liability of $100,000 or more on any day during a deposit period, you

must deposit the tax by the next business day, whether you are a monthly or semiweekly schedule depositor.

Monthly depositors must then follow the semiweekly schedule for the rest of the year. For more information

about the $100,000 Next-Day Deposit Rule and the applicable deposit period, see Publication 15. (Circular E),

Employer’s Tax Guide, Depositing Taxes.

Remember: Deposit rules are based on when wages are paid, not earned. For example, monthly schedule

depositors with wages earned in June, but paid in July, deposit August 15. Form 945 and Form 1042 may

have dierent deposit requirements. For more information, refer to the form instructions or contact your Indian

Tribal Governments specialist. Some businesses paying a minimal amount of tax may make their payments

with the tax returns.

16

Gaming Tax Law and Bank Secrecy Act Issues

Resource

The Employer’s Tax Calendar from Publication 509, Tax Calendars, lists due dates for ling returns and for

making employment tax deposits throughout the year. Use this calendar with Publication 15, which explains

the deposit rules.

Employment Tax Penalties

Employment tax penalties can multiply quickly. There are three main employment tax penalties: failure to

deposit, failure to le and failure to pay. These penalties are often assessed at the same time.

• Failure to deposit - this penalty reaches 10% when past due by 16 days. This means even before the return

is due you could have a 10% penalty.

• Failure to le - accrues at 5% per month reduced by applicable failure to pay penalty, capping at 25%.

• Failure to pay - begins accruing once the return due date has passed and all tax is not paid, also capping

at 25%.

Example: The last deposit of the quarter is due at the end of the month and it is not paid. Your employment

tax return preparer misses a week of work beginning near the last day of the next month (when the return is

due). At this point, the deposit is late, the return is late and failure to pay the tax is now assessed. For being

45 days late the penalties are 15% and increasing by 5% per month for the next 4 months, going from 15% to

35%. If the last deposit was supposed to be $20,000 then the penalty at 45 days is $3,000 and at 5 months is

$7,000.

For more information see the chapter on penalties in Publication 4268, Employment Tax For Indian Tribal

Governments, and Publication 5343, Helpful Hints for Indian Tribes and Tribal Entities to Avoid Penalties on

Federal Tax Deposits and Information Returns.

Trust Fund Recovery Penalty (Failure to Withhold and Pay Employment Tax)

A trust fund recovery penalty may apply when an employer does not withhold or deposit employment tax

that is withheld or supposed to be withheld. This penalty can be applied to any entity, including governmental

entities such as Indian tribes. Under this penalty, ocers or employees of a tribal gaming operation could

become personally liable for the tax payment and could be penalized an amount equal to the unpaid tax.

This penalty may apply when unpaid tax cannot be immediately collected from the tribal gaming operation.

The trust fund recovery penalty may be imposed on anyone the IRS determines is responsible for collecting,

accounting for and depositing this tax, and who acted willfully in not doing so. Willfully, in this case, means

voluntarily, consciously and intentionally.

17

Gaming Tax Law and Bank Secrecy Act Issues

SECTION V TAX ON WAGERING

Denitions

This section explains the application of excise tax on wagering (wagering tax and occupational tax) on tribal

gaming operations conducting certain games, such as bingo games, pull-tabs, raes and tip boards.

Tribes that conduct gaming activities should be aware that wagering tax and occupational tax might apply

based on the gaming activities that are oered. The facts and circumstances of the types of wagering

conducted, as well as the benets derived, may have a bearing on whether the wagers are subject to tax.

There are two types of wagering tax: wagering tax imposed on the gross amount of a wager, and an

occupational tax imposed on persons engaged in receiving taxable wagers. In general, the tax on wagering

applies to:

• Wagers placed on a sports event or contest with a person engaged in the business of accepting wagers.

• Wagers placed in a wagering pool on a sports event or contest, if the pool is conducted for prot.

• Wagers placed in a lottery conducted for prot (other than a state-conducted lottery).

Note: Pull-tabs, raes and tip jar games generally are taxable lotteries. Bingo (not instant bingo) is

specically excluded from the wagering tax. Keno may be excluded from the wagering tax. The general

rule is if a Keno game is live, meaning all players are present and winnings are paid before the beginning of

the next game, it is not subject to the gaming excise tax. Generally, with Keno games over 20, the player

may leave and collect his winnings later (usually up to one year). This type of Keno game is subject to the

wagering tax. Contact the Indian Tribal Governments specialist in your area with questions on the wagering

tax to a specic game.

The gross amount of the wager upon which tax is imposed is the amount risked by the bettor, including any

charge or fee incident to placing the wager. The taxable amount, for purposes of the excise tax, does not

depend on the amount that a bettor may win in the wager.

The law specically exempts certain wagers from the wagering tax (gaming exemptions related to games

conducted by a state or state agencies are beyond the scope of this publication). Exemptions relevant to

Indian tribal government gaming include wagers placed:

1. With a pari-mutuel wagering enterprise, including horse racing, dog racing and jai alai, licensed under state

law;

2. In a coin-operated device, such as slot machines, pinball machines or video games (including electronic

pull-tab machines); and

3. Through drawings conducted by an organization exempt from tax under IRC Sections 501 and 521, as long

as the net proceeds of the drawing do not benet a private shareholder or individual.

See Form 730, Monthly Tax Return for Wagers.

Wagering Excise Tax

The wagering tax is imposed on gross wagers received before any payout of prizes or other expense.

Example: The wagering tax applies to an organization selling pull-tabs. The tax applies to the gross sales per

box. If a box of $1 pull-tabs contains 2,400 cards and the entire box is sold, the tax is computed on $2,400.

18

18

Gaming Tax Law and Bank Secrecy Act Issues

Rate of Tax

The tax rate depends upon whether the wager is authorized under the law of the state in which it is accepted:

• If the wager is authorized under the law of the state in which it is accepted, the rate of tax is 0.25% of the

the wager. Thus, if the gross wagers are $1,000, the tax is $2.50 ($1,000 x .0025).

• If a wager is not authorized under the law of the state in which it is accepted, the rate of tax is 2% of the

wager. Thus, if the gross wagers are $1,000, the tax is $20 ($1,000 x .02).

Filing IRS Form 730, Monthly Tax Return for Wagers

To report and le taxable wagers, you must le Form 730. This is a monthly return that must be led by the

last day of the month following the month you report taxable wagers. Once you begin ling, Form 730 must

be led each month until a nal return is led, even if you receive no wagers in a month. These returns will

report a liability of zero for the month. If you stop accepting wagers, you must le a nal Form 730. Check the

“Final Return” box on the form. The instructions to Form 730 provide additional ling information. A tribe may

be subject to a penalty for failure to le the form and for failure to pay the tax.

Occupational Tax

The occupational tax is imposed on those who receive wagers that are subject to tax. The tax applies to

persons receiving taxable wagers, whether they receive compensation or are volunteers.

Persons required to pay tax must register certain information with the IRS. This includes both principals

(persons in the business of accepting taxable wagers on their own behalf) and agents (persons who accept

taxable wagers on behalf of a principal). Both principals and agents must le Form 11-C, Occupational Tax

and Registration Return for Wagering, to register and to pay the occupational tax before they accept wagers

and annually thereafter (presently due on July 1). An employer identication number (EIN) must be used on

Form 11-C, not a Social Security number. If a principal or agent does not have an EIN, they must apply for

one by:

• Visiting www.irs.gov/ein and applying online;

• Calling 800-829-4933; or

• Mailing a completed Form SS-4, Application for Employer Identication Number, to the IRS. Attach a copy

of the SS-4 to the Form 11-C when the Form 11-C is led.

Example: A tribe sells pull-tabs and arranges for 10 people to receive wagers from the public on the tribe’s

behalf. The tribe also employs a secretary and a bookkeeper. The tribe and each of the 10 people are liable

for the occupational tax. They must each le Form 11-C and pay the occupational tax. The secretary and

bookkeeper are not liable for the tax unless they also accept wagers for the tribe.

Tax Amount

You must pay the occupational tax if you accept taxable wagers for yourself or another person. There are two

amounts of occupational tax ($50 or $500). One or the other applies depending on whether the wagers you

accept are authorized by the laws of the state in which you accept the wager.

• If yes, then the amount of the occupational tax is $50 per year per person.

• For all other wagers, the amount of the tax is $500 per year per person.

19

Gaming Tax Law and Bank Secrecy Act Issues

Example: A tribe sells pull-tabs at its tribally-owned gas stations through paid employees of the tribe. In

the state where the tribe is located, the sale of pull-tabs must be conducted by volunteer labor. The tribe

is liable for the wagering tax at a rate of 2%. Because it is liable for the tax, the tribe is also subject to the

occupational tax at the amount of $500 per person selling pull-tabs.

The tribe is subject to the 2% rate and $500 amount because the wager is not authorized under the law of the

state in which it is accepted. State law only allows the sale of pull-tabs by volunteer labor, and this tribe uses

paid cashiers to sell the pull-tabs.

20

Gaming Tax Law and Bank Secrecy Act Issues

SECTION VI FILING REQUIREMENTS

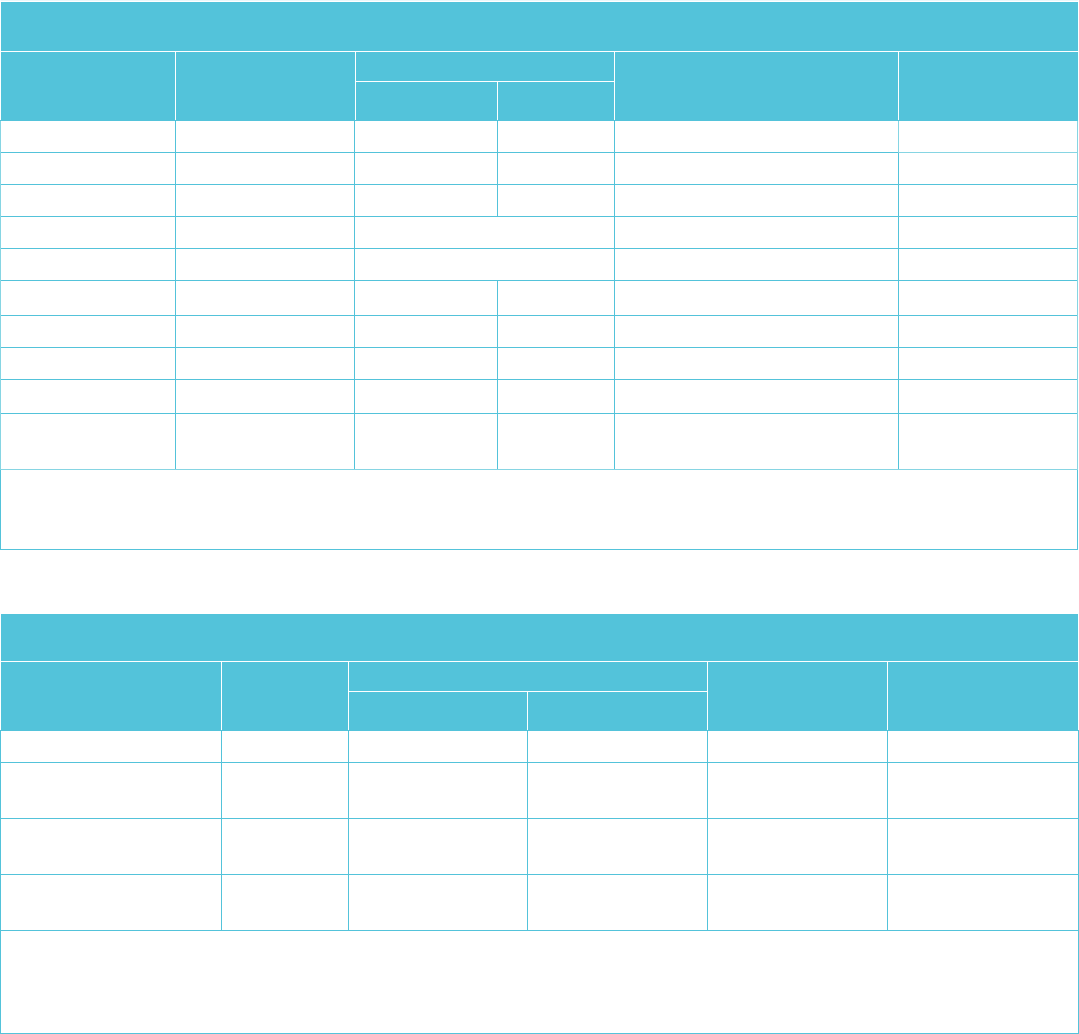

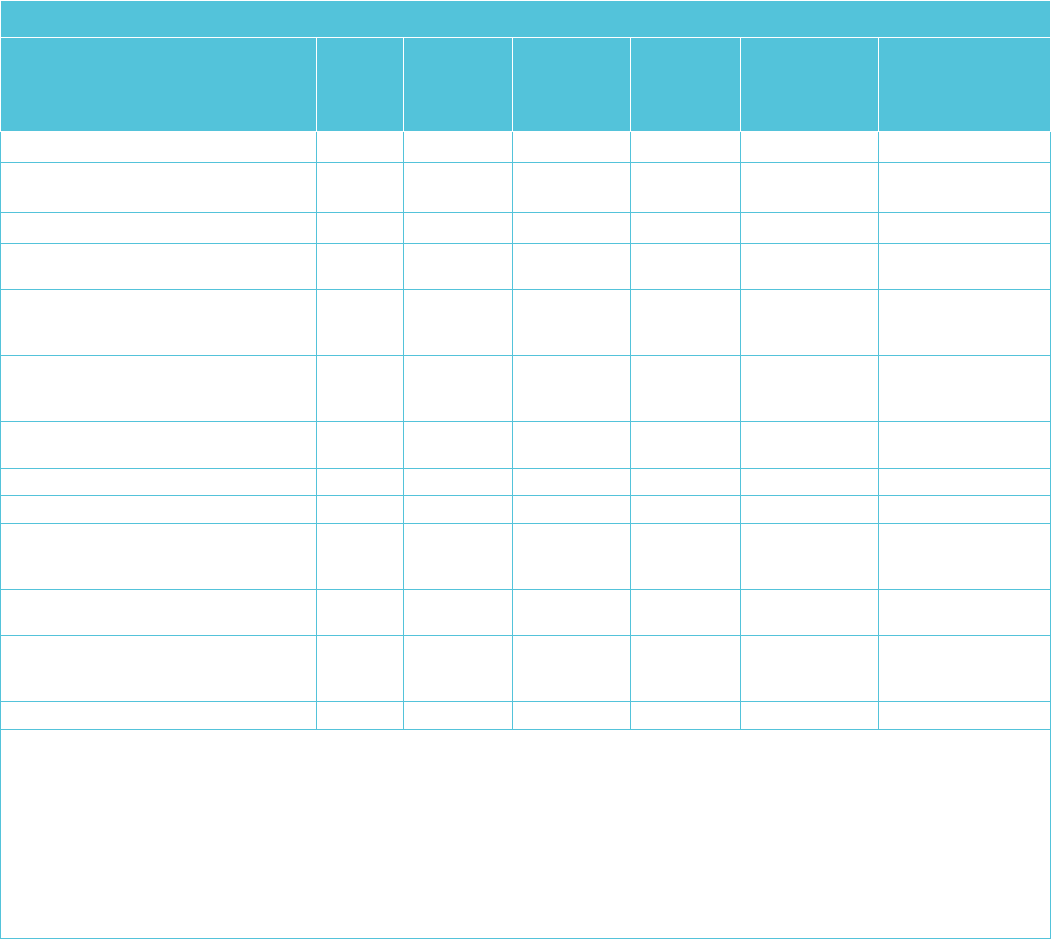

Summary Filing Requirements for Tribal Gaming Operations

Business Operations

User Form

Send to IRS

Comments ReferenceReporting Payment

Employer 941 Mail EFTPS Sec IV

Employer W-2 Mail/SSA BSO N/A Paper filing requires Form W-3 Sec IV

Employer 940* Mail EFTPS Sec IV

All employees FinCEN SAR BSA E-Filing System Sec II

Cash reporting FinCEN CTR BSA E-Filing System Sec II

Pull-tabs etc. 730 Mail EFTPS Sec V

Pull-tabs etc. 11-C Mail EFTPS Sec V

Resident vendor 1099-MISC Mail/FIRE EFTPS

1

Paper filing requires Form 1096 Sec II

Nonresident vendor 1042-S Mail/FIRE EFTPS

2

Paper filing requires Form 1042-T Sec II

Food/beverage 8027 Mail/FIRE N/A

Paper filing requires Form 8027-T

when multiple venues

Sec IV

*If not participating in a state unemployment program

1

Report on Form 945 if withholding required

2

Report on Form 1042 if withholding required

Patrons

Recipient** Form

Send to IRS

Comments Reference

Reporting Payment

Winnings to resident W-2G Mail/FIRE EFTPS

1

Sec VI

Prizes to resident 1099-MISC Mail/FIRE EFTPS

1

Paper filing requires

Form 1096

Sec VI

Winnings to nonresident 1042-S Mail/FIRE EFTPS

2

Paper filing requires

Form 1042-T

Sec VI

Prizes to nonresident 1042-S Mail/FIRE EFTPS

2

Paper filing requires

Form 1042-T

Sec VI

** Consult the OFAC SDN list prior to payment to ensure that it is not a prohibited transaction. If there are multiple winners or nominee winners, then

prepare and retain Form 5754.

1

Report on Form 945 if withholding required

2

Report on Form 1042 if withholding required

21

Gaming Tax Law and Bank Secrecy Act Issues

IRS Tax Forms to File for Gaming Activities

Forms W-2G, 1099, 945, 1042-S, 1042

Determining the right form to le requires knowledge about the type of winnings as well as the person

receiving them. Most individuals will receive either Form W-2G or Form 1099-MISC depending on their

winnings. However, foreign individuals will receive Form 1042-S.

File Form W-2G, Certain Gambling Winnings, when an individual wager results in a win (jackpot) with a

minimum specic dollar amount at a gaming event.

Tribal gaming operations generally report winnings if the amount is $600 or more and at least 300 times the

amount of the wager. However, these requirements do not apply to winnings from bingo, electronic gaming

devices (for example, slot machines) and keno. Winnings (not reduced by the wager) from a bingo game or

slot machine of $1,200 or more are reportable gaming winnings. Winnings from a keno game (reduced by the

wager) of $1,500 or more are reportable gaming winnings.

File Form 1099-MISC when a prize is awarded from an event without a wager. When ling paper returns,

transmit to the IRS Form W-2G and Form 1099-MISC (with Form 1096, Annual Summary and Transmittal of

U.S. Information Returns). You will nd more information on Form 1042-S ling and withholding requirements

on foreign winners (as well as Form 1042 ling requirements) in the Verifying Residency section of this

publication.

In addition to ling information returns, you may be required to withhold on gaming winnings. Deposit this

withholding with the IRS and reconcile on annual returns using either Form 945 or Form 1042. For more

information on Form 945 see the Reporting and Withholding Gaming Winnings section of this publication.

Identication Requirements

Form W-2G must contain the winner’s name, address and Social Security number. It must also contain a

general description of two types of valid identication (for example, driver’s license, Social Security card

or voter registration card) furnished to the gaming operator who will use these to verify the winner’s name,

address and Social Security number. A valid ID is an unexpired government-issued form.

Examples of ocial government-issued IDs include:

• Driver’s license

• State-issued identication card

• Tribal-issued identication card

• Passport

• Alien registration card

• Military identication

If a gaming operator makes a payment without securing the winner’s TIN, they must perform backup

withholding on the winnings. See page 27 for more information about backup withholding and Form 945 ling

requirements.

The verication requirements for Form 1099-MISC are not the same as Form W-2G. While Form 1099-MISC

also requires the winner’s name, address and Social Security number, it does not require two separate forms

of ID or descriptions. One valid photo identication is recommended to verify the name and address. You can

substitute a Form W-9 for a Social Security card to certify a winner’s TIN. The patron does not sign the Form

1099-MISC.

22

Gaming Tax Law and Bank Secrecy Act Issues

Reporting and Withholding Gaming Winnings

The following presumes the winner is a U.S. resident. Foreign persons are subject to dierent withholding

requirements. For more information on winners who are foreign persons, see the section on Verifying

Residency.

Report gambling winnings on Form W-2G if:

• The winnings (not reduced by the wager) from a bingo game or slot machine are $1,200 or more;

• The winnings (reduced by the wager) from a keno game are $1,500 or more;

• The winnings (reduced by the wager or buy-in) from a poker tournament are more than $5,000;

• The winnings (except winnings from bingo, slot machines, keno and poker tournaments) reduced, at the

option of the payer, by the wager are $600 or more and at least 300 times the amount of the wager; or

• The winnings are subject to federal income tax withholding (either regular gambling withholding or backup

withholding).

Types of Winnings

Regular Bingo Game Win – A bingo game operator must complete Form W-2G for a single bingo win of

$1,200 or more. The winner must furnish the bingo game operator with their TIN (typically Social Security

number).

Example 1: A tribal gaming operation conducts a weekly bingo game. A payout of $1,300 is made for a single

game. The winner furnishes identifying information, along with the TIN to the tribal gaming operation. The

tribal gaming operation must complete Form W-2G, but is not required to withhold income tax.

If the winner does not provide a TIN, the bingo game operator must withhold tax (known as backup

withholding) at the current backup withholding rate.

Example 2: If the winner in Example 1 had refused to provide their TIN, the tribal gaming operation would

complete Form W-2G without the TIN and apply backup withholding. The gaming operation reports withheld

income tax on Form 945, Annual Return of Withheld Federal Income Tax. In 2018 the winner would receive

$988 ($1,300 gross winnings minus $312 - federal income tax withheld at the rate of 2018 backup withholding

rate of 24%). (Rates can change – check irs.gov for the current rate).

Lotteries, Sweepstakes, Horse Races, Dog Races, Instant Bingo Game Wins/Pull-Tabs, Jai Alai and

Other Wagering Transactions – A single win less than $600 involving lotteries, sweepstakes, horse races,

dog races, instant bingo game wins/pull-tabs, jai alai and other wagering transactions does not require

completing a Form W-2G or withholding federal income tax.

A single win of at least $600 requires completing a Form W-2G if the prize is at least 300 times the amount of

the wager. The winner must furnish proper identication to the game operator along with their TIN. If the TIN

isn’t provided, the game operator must withhold tax at the current backup withholding rate. See Section VI

for identication requirements. Backup withholding applies to the amount of winnings reduced, at the option

of the payer, by the amount wagered. See Reportable Gambling Winnings in the Instructions for Forms W-2G

and 5754 for more information.

Example 1: A tribal gaming operation sells pull-tabs at its weekly bingo session. Each pull-tab costs $1. One

type of pull-tab sold pays a progressive jackpot. The winning ticket from each box entitles the ticket holder to

23

Gaming Tax Law and Bank Secrecy Act Issues

select a number from a second punchboard without making an additional wager. If the ticket holder selects

the winning punchboard number, the holder wins the jackpot. If the winning ticket holder does not select the

winning punchboard number, the gaming operation may pay a consolation prize. The jackpot is increased and

carried over to the next box of pull-tabs sold. If a patron wins $100 on the winning ticket from the box of pull-

tabs and then selects a winning number from the progressive punchboard that pays $550, the tribal gaming

operation must complete a Form W-2G. Since the initial ticket purchase entitled the patron to both amounts,

the gaming operation combines them as a single win of $649 ($650 - $1 – the pull-tab cost).

Example 2: A tribal gaming operation sells instant bingo game tickets. A winner receives $950 from one

of the pull-tabs that cost $1. The winner refuses to provide their identication number; therefore, the tribe

must complete Form W-2G and withhold 24% of the winnings. The gaming operation reports the income tax

withheld on Form 945. The winner receives $721.24 ($950 minus $1 wager, less $227.76 federal income tax

withheld at the rate of 24% ($949 x .24 = $227.76).

Wins of more than $5,000 – If a single win, less the wager, exceeds $5,000, the gaming operation must

complete a Form W-2G and withhold on the net winnings at the current rate.

Example 3: A tribal gaming operation has a winner of $5,100 from one of the pull-tabs, which cost $10.

Because the winnings, less the wager, exceed $5,000, complete Form W-2G and withhold federal income

tax. Report the income tax withheld on Form 945. If the winner provides identication, the winner receives

$3,878.40 ($5,100 gross winnings less $1,221.60 withholding tax = computed $5,100 minus $10 wager, times

24%).

The following chart describes when a tribal gaming operation must issue a Form W-2G:

Game Win is Equal to or Greater Than

Lotteries, sweepstakes, horse races, dog races, instant bingo game

prizes/pull-tabs, jai alai and other wagering transactions

1

$600

Bingo $1,200

Slot machines $1,200

Keno $1,500

1

and at least 300 times the amount of the wager is subject to income tax withholding

Multiple Winners – When paying out a win from a wagering activity, a tribal gaming operation needs to

determine whether it’s paying a member of a group of two or more winners on a single ticket or to a person

who is not the actual winner.

If so, the tribal gaming operation must obtain a completed Form 5754, Statement by Person(s) Receiving

Gambling Winnings. This form enables the tribal gaming operation to prepare Form W-2G. There are two parts

to Form 5754. The rst part lists the identication of the person who is receiving the winnings. The second

part lists the actual winners and their respective share of the winnings. The tribal gaming operation must use

the information to complete Form W-2G for each winner. The tribal gaming operation does not submit Form

5754 to the IRS, but it should keep the form with its tax records for four years.

The amount paid on the winning ticket, not each individual’s share of the proceeds, determines whether the

tribal gaming operation will need to complete a Form W-2G.

Example: A tribal gaming operation sells pull-tabs at its weekly bingo session. John Doe and Judy Smith

24

Gaming Tax Law and Bank Secrecy Act Issues

jointly purchased a $1 pull-tab that was the winning ticket of a $1,200 jackpot. John Doe appears at the cage

to redeem the pull-tab.

If John and Judy contributed equal amounts toward the purchase of the ticket and agreed to share equally in

any winnings, complete Form 5754 as follows:

• Part I - List the name, address and identication number of the individual who was actually paid (win must

be paid to one individual). In the box for amount received, include the total $1,200 win.